Europe

Number of European VC deals nosedive as early-stage investment dries up

In Q2'17 European VC-backed companies raised across 589 deals

Europe continued to see a pullback in the number of VC deals during Q2’17, with seed and early-stage deals plummeting. Despite a fifth straight quarterly decline in deals volume, however, total VC investment in Europe remained strong as a result of a number of mega-deals. Three $100 million+ deals together accounted for $1 billion in European VC funding, including $502 million to London-based Improbable, $397 million to Berlin-based Auto1 Group, and $100 million to London-based GammaDelta Therapeutics. Governments set to help plug early-stage funding gaps Several European governments recently announced programs that could help address declines in funding at the seed and angel deal stages. In Q2’17, as part of its commitment to sustaining a strong startup and scale up ecosystem post-Brexit, the UK announced that the British Business Bank would extend the limits on its current venture capital investment program and introduce new supports to help start-up companies and small businesses in the country.8 Germany announced that it would double the amount of VC funding available to start-ups by the year 2020, and invest €2 billion over the next 10 years into the innovation ecosystem9. The French government also announced plans to sell assets to create an €10 billion fund to invest in disruptive innovation.10 B2B hybrid opportunities thriving in Germany In Germany, B2B tech opportunities gained prominence in the eyes of VC investors during the quarter. In Q2’17, two significant deals involved B2B opportunities: a $397.6 million funding round to Auto1 Group and $421 million in private equity funding to Delivery Hero. Both Auto1 Group and Delivery Hero offer mechanisms for companies to provide better services to their diverse customers — a value proposition that is only expected to gain traction across industries over time. Regardless of Brexit plans, UK continues to attract VC investment Brexit concerns continued to be a non-issue for many VC investors in the UK during Q2’17. In fact, London-based virtual reality firm Improbable hosted a $500 million+ Series B funding round during the quarter, making it one of the largest VC deals ever conducted in the country. The ability for Improbable to attract funding during a low risk investment climate bodes well for the robustness of the UK innovation ecosystem. Despite Brexit plans, the country remains highly attractive to startups and investors as a result of its strong talent base, leading universities, and government incentives and support programs. Israel taking the lead in smart transportation Israel has long been a hub for technologies that can foster innovations across industries, such as machine learning, cybersecurity, analytics, and sensors. Intel’s acquisition of Mobileye in Q1’17 only increased the attention investors have been placing on Israel. Because of this, more investments in smart transportation related technologies are expected over the next few quarters. There is also expected to be an increase in investments to Israeli software companies that can maximize the value of new technologies (e.g. platform management, data analytics). 8 https://www.thestreet.com/video/14180135/british-government-launches-plan-to-help-the-country-as-it-leaves-the-eu.html 9 https://www.thelocal.de/20170612/new-german-state-firm-to-give-startups-boost-with-2-billion-injection-report 10 https://www.wsj.com/articles/france-to-create-10-billion-fund-to-invest-in-innovation-1499279714?mod=wsjde_finanzen_wsj_barron_tickers © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

French VC market experiences rapid growth The VC market in France gained momentum during Q2’17 with a significant increase in VC investment and interest quarter over quarter. VC interest is only expected to increase heading into Q3, as Station F — a massive startup incubator — opened with the support of numerous global companies, including Microsoft, Ubisoft, Amazon and others. France’s new president Emmanuel Macron also recently announced the introduction of a new ‘talent passport’ aimed at attracting critical talent to the country, and proposed a new European Venture Fund to help foster the growth of startups.11 On the M&A front, Snap, Inc. (SnapChat) made headlines with the acquisition of Paris-based startup Zenly for $250M - $350M. Ireland continues to gain traction among global VC investors Ireland’s VC market remained robust in Q2’17. A $65 million raise by Iterum Therapeutics was among the top 10 European deals during the quarter, while a number of smaller deals also showcased Ireland’s growing innovation expertise. Fintech remains one of Ireland’s strongest tech sectors, able to attract early-stage funding despite the risk-adverse funding market. In Q2’17, payments messaging app Plynk successfully raised €25 million in Series A funding to help scale its operations and fuel global growth. Trends to watch for in Europe Despite significant uncertainty, the outlook for VC investment in Europe remains positive given the rapid evolution of tech hubs across the region. While the UK, Israel and Germany will likely continue to be leading hubs of investment, France, Ireland and Scandinavia are expected to continue to grow on the radar of investors. Investments in artificial intelligence, analytics, blockchain and B2B-focused technologies are also expected to increase over the next two to three quarters. Q2’17’s Improbable deal may also spur additional investments in virtual reality. 11 http://www.cnbc.com/2017/06/15/french-president-macron-france-should-be-a-country-of-unicorns.html © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

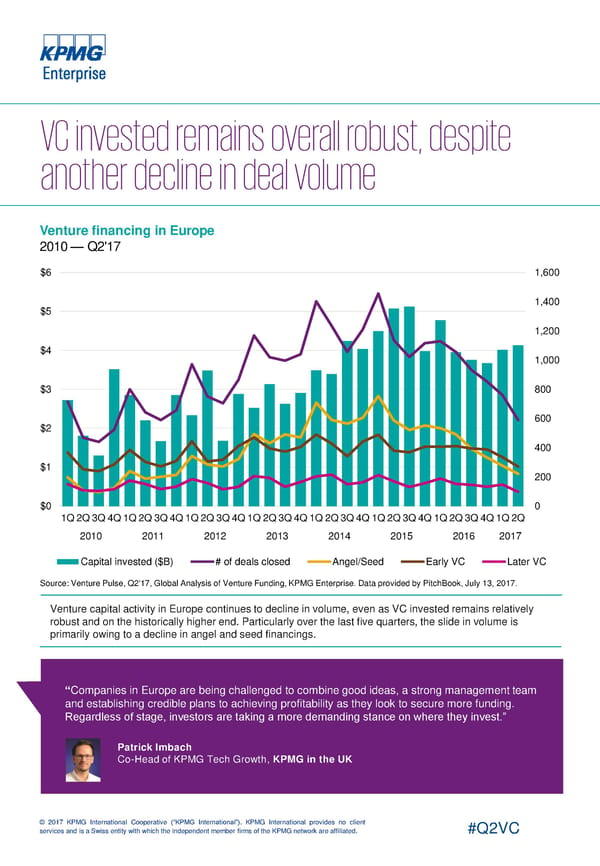

Venture financing in Europe 2010 — Q2'17 $6 1,600 $5 1,400 1,200 $4 1,000 $3 800 $2 600 400 $1 200 $0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Capital invested ($B) # of deals closed Angel/Seed Early VC Later VC Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Venture capital activity in Europe continues to decline in volume, even as VC invested remains relatively robust and on the historically higher end. Particularly over the last five quarters, the slide in volume is primarily owing to a decline in angel and seed financings. “Companies in Europe are being challenged to combine good ideas, a strong management team and establishing credible plans to achieving profitability as they look to secure more funding. Regardless of stage, investors are taking a more demanding stance on where they invest.” Patrick Imbach Co-Head of KPMG Tech Growth, Patrick Imbach KPMG in the UK Co-Head of KPMG Tech Growth, KPMG in the UK © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

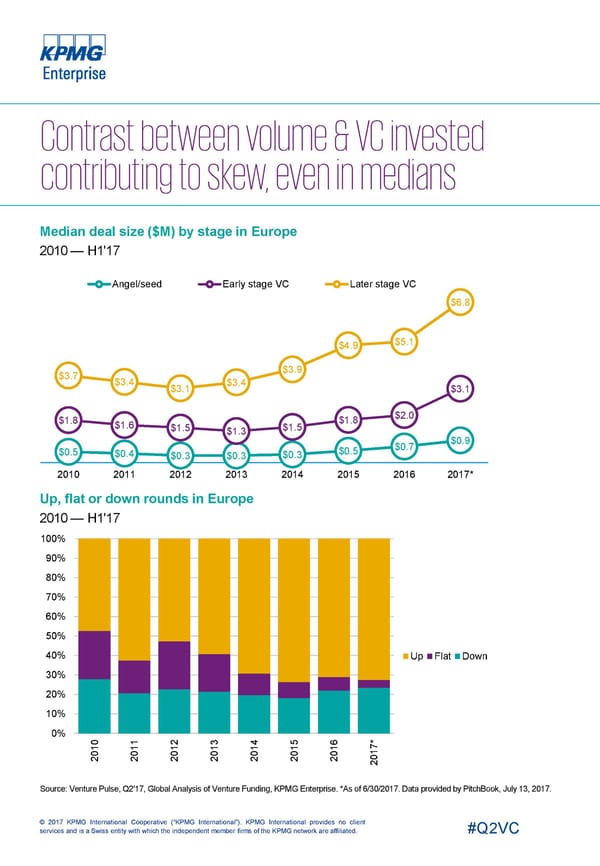

Median deal size ($M) by stage in Europe 2010 — H1'17 Angel/seed Early stage VC Later stage VC $6.8 $5.1 $4.9 $3.9 $3.7 $3.4 $3.4 $3.1 $3.1 $2.0 $1.8 $1.8 $1.6 $1.5 $1.5 $1.3 $0.9 $0.7 $0.5 $0.5 $0.4 $0.3 $0.3 $0.3 2010 2011 2012 2013 2014 2015 2016 2017* Up, flat or down rounds in Europe 2010 — H1'17 100% 90% 80% 70% 60% 50% 40% Up Flat Down 30% 20% 10% 0% 0 1 2 3 4 5 6 * 1 1 1 1 1 1 1 7 0 0 0 0 0 0 0 1 2 2 2 2 2 2 2 0 2 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

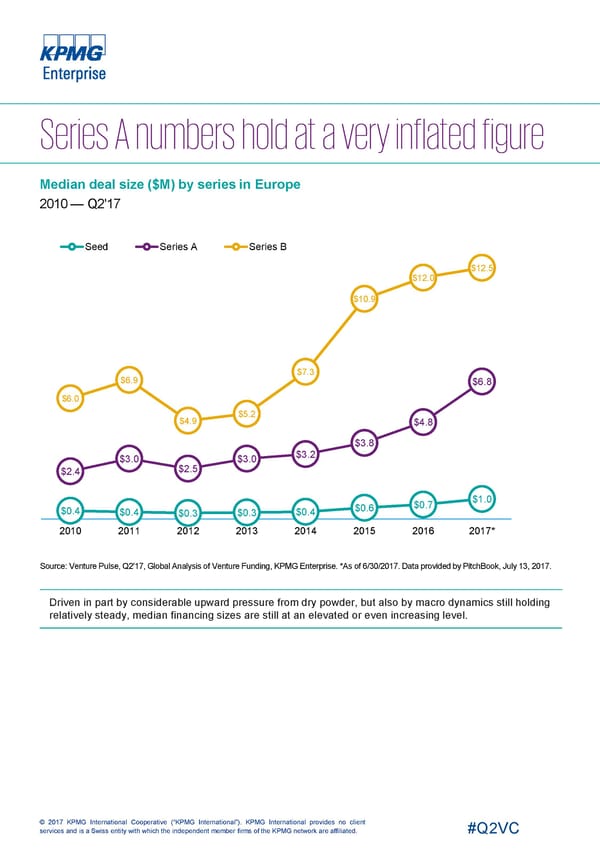

Median deal size ($M) by series in Europe 2010 — Q2'17 Seed Series A Series B $12.5 $12.0 $10.9 $7.3 $6.9 $6.8 $6.0 $5.2 $4.9 $4.8 $3.8 $3.2 $3.0 $3.0 $2.5 $2.4 $1.0 $0.7 $0.6 $0.4 $0.4 $0.4 $0.3 $0.3 2010 2011 2012 2013 2014 2015 2016 2017* Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. Driven in part by considerable upward pressure from dry powder, but also by macro dynamics still holding relatively steady, median financing sizes are still at an elevated or even increasing level. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

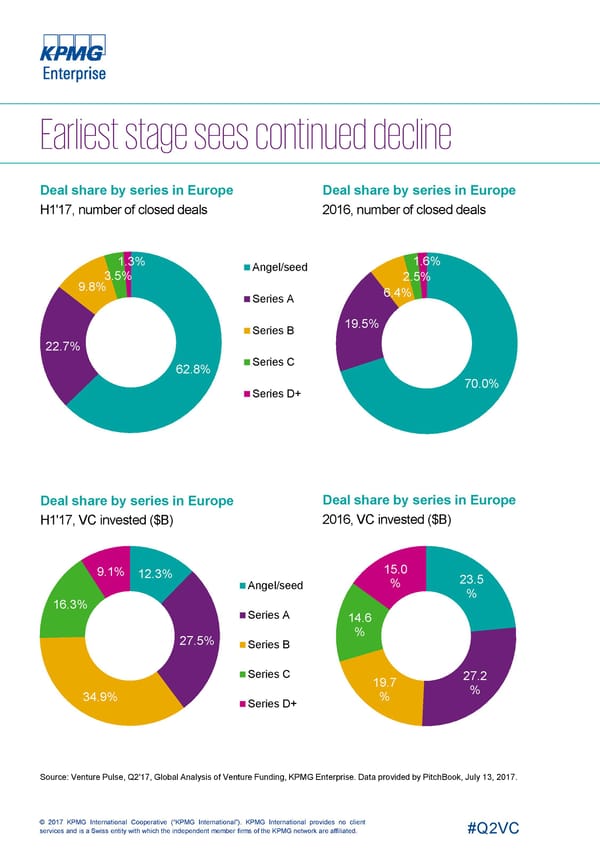

Deal share by series in Europe Deal share by series in Europe H1'17, number of closed deals 2016, number of closed deals 1.3% 1.6% Angel/seed 3.5% 2.5% 9.8% 6.4% Series A 19.5% Series B 22.7% Series C 62.8% 70.0% Series D+ Deal share by series in Europe Deal share by series in Europe H1'17, VC invested ($B) 2016, VC invested ($B) 15.0 9.1% 12.3% 23.5 % Angel/seed % 16.3% Series A 14.6 % 27.5% Series B Series C 27.2 19.7 % 34.9% % Series D+ Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

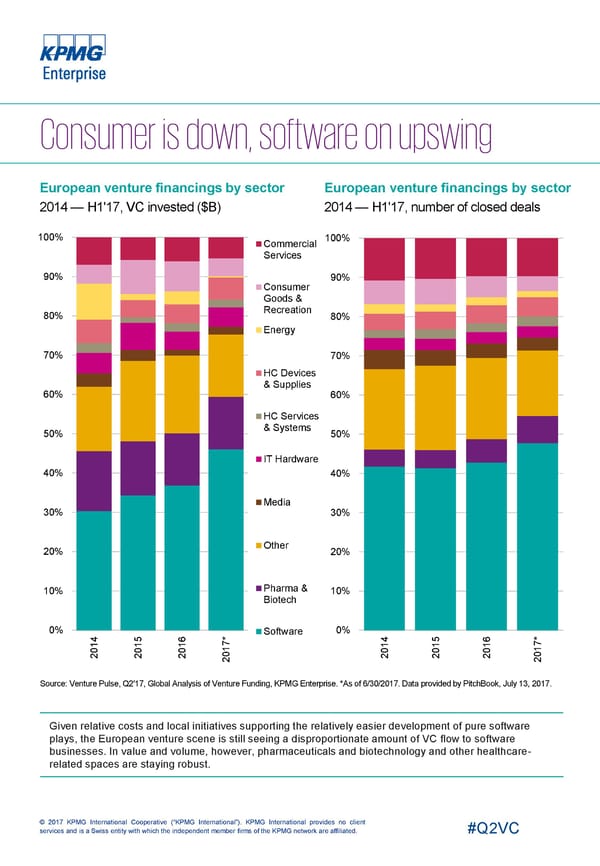

European venture financings by sector European venture financings by sector 2014 — H1'17, VC invested ($B) 2014 — H1'17, number of closed deals 100% 100% Commercial Services 90% 90% Consumer Goods & Recreation 80% 80% Energy 70% 70% HC Devices & Supplies 60% 60% HC Services & Systems 50% 50% IT Hardware 40% 40% Media 30% 30% Other 20% 20% Pharma & 10% 10% Biotech 0% 0% Software 5 6 * 4 5 6 * 14 1 1 7 1 1 1 7 0 0 1 0 0 0 1 20 2 2 0 2 2 2 0 2 2 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook,July 13, 2017. Given relative costs and local initiatives supporting the relatively easier development of pure software plays, the European venture scene is still seeing a disproportionate amount of VC flow to software businesses. In value and volume, however, pharmaceuticals and biotechnology and other healthcare- related spaces are staying robust. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

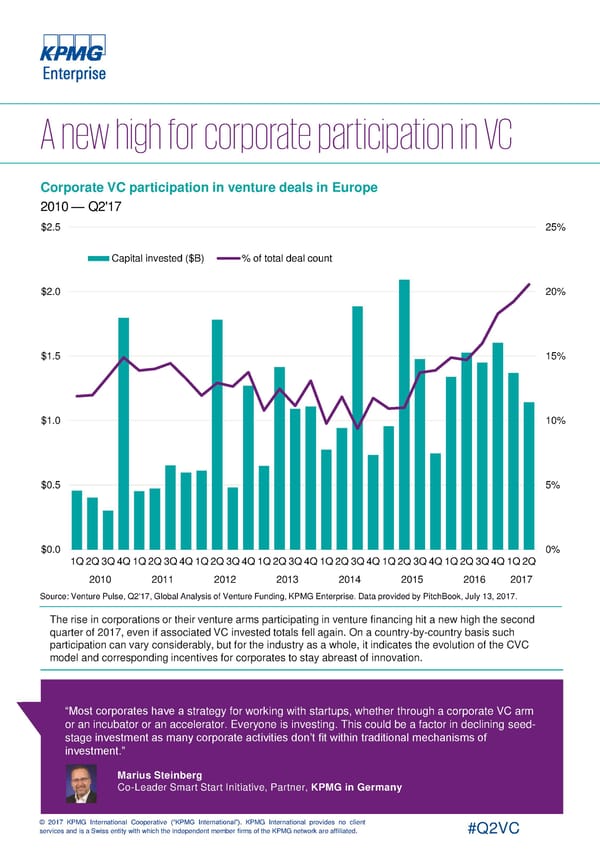

Corporate VC participation in venture deals in Europe 2010 — Q2'17 $2.5 25% Capital invested ($B) % of total deal count $2.0 20% $1.5 15% $1.0 10% $0.5 5% $0.0 0% 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. The rise in corporations or their venture arms participating in venture financing hit a new high the second quarter of 2017, even if associated VC invested totals fell again. On a country-by-country basis such participation can vary considerably, but for the industry as a whole, it indicates the evolution of the CVC model and corresponding incentives for corporates to stay abreast of innovation. “Most corporates have a strategy for working with startups, whether through a corporate VC arm or an incubator or an accelerator. Everyone is investing. This could be a factor in declining seed- stage investment as many corporate activities don’t fit within traditional mechanisms of investment.” Marius Steinberg Co-Leader Smart Start Initiative, Partner, KPMG in Germany © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

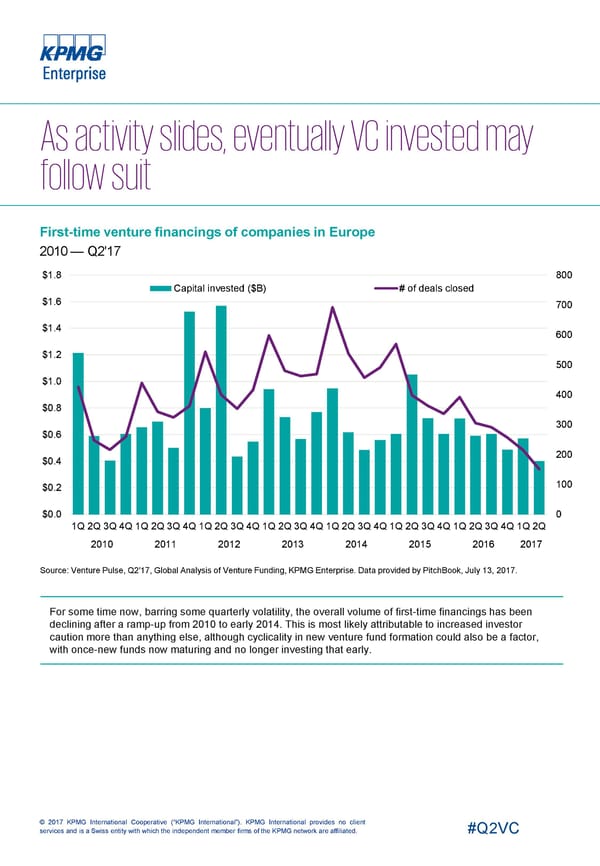

First-time venture financings of companies in Europe 2010 — Q2'17 $1.8 800 Capital invested ($B) # of deals closed $1.6 700 $1.4 600 $1.2 500 $1.0 400 $0.8 300 $0.6 200 $0.4 100 $0.2 $0.0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. For some time now, barring some quarterly volatility, the overall volume of first-time financings has been declining after a ramp-up from 2010 to early 2014. This is most likely attributable to increased investor caution more than anything else, although cyclicality in new venture fund formation could also be a factor, with once-new funds now maturing and no longer investing that early. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

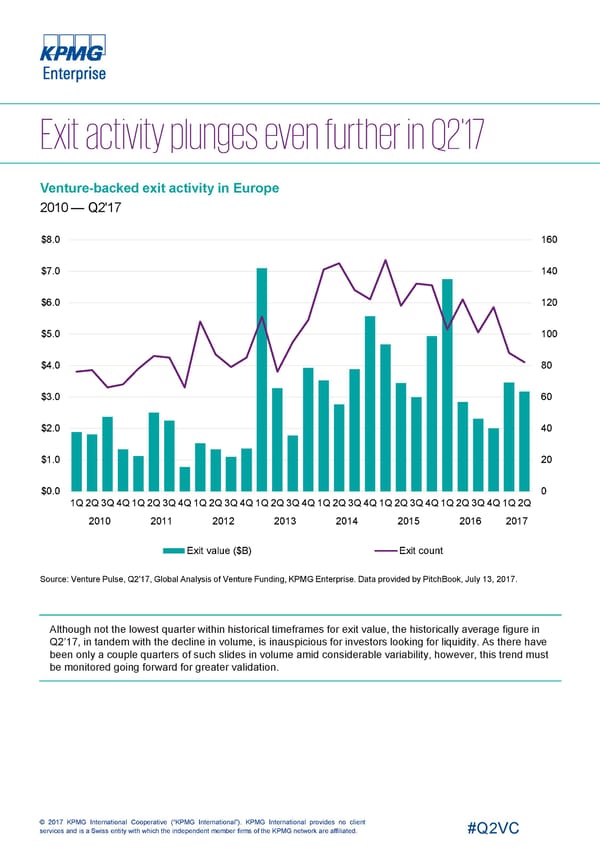

Venture-backed exit activity in Europe 2010 — Q2'17 $8.0 160 $7.0 140 $6.0 120 $5.0 100 $4.0 80 $3.0 60 $2.0 40 $1.0 20 $0.0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Exit value ($B) Exit count Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Although not the lowest quarter within historical timeframes for exit value, the historically average figure in Q2’17, in tandem with the decline in volume, is inauspicious for investors looking for liquidity. As there have been only a couple quarters of such slides in volume amid considerable variability, however, this trend must be monitored going forward for greater validation. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

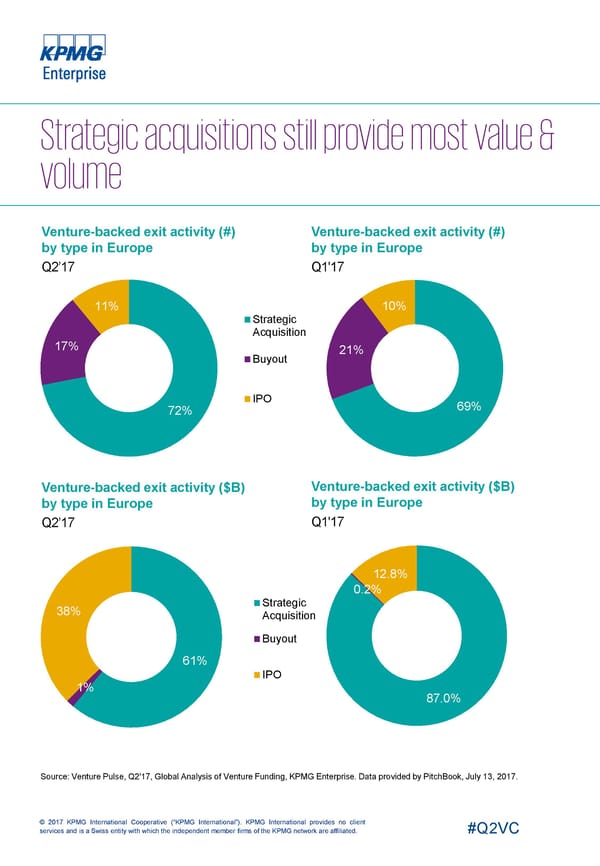

Venture-backed exit activity (#) Venture-backed exit activity (#) by type in Europe by type in Europe Q2’17 Q1'17 11% 10% Strategic Acquisition 17% 21% Buyout IPO 69% 72% Venture-backed exit activity ($B) Venture-backed exit activity ($B) by type in Europe by type in Europe Q2’17 Q1'17 12.8% 0.2% Strategic 38% Acquisition Buyout 61% IPO 1% 87.0% Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

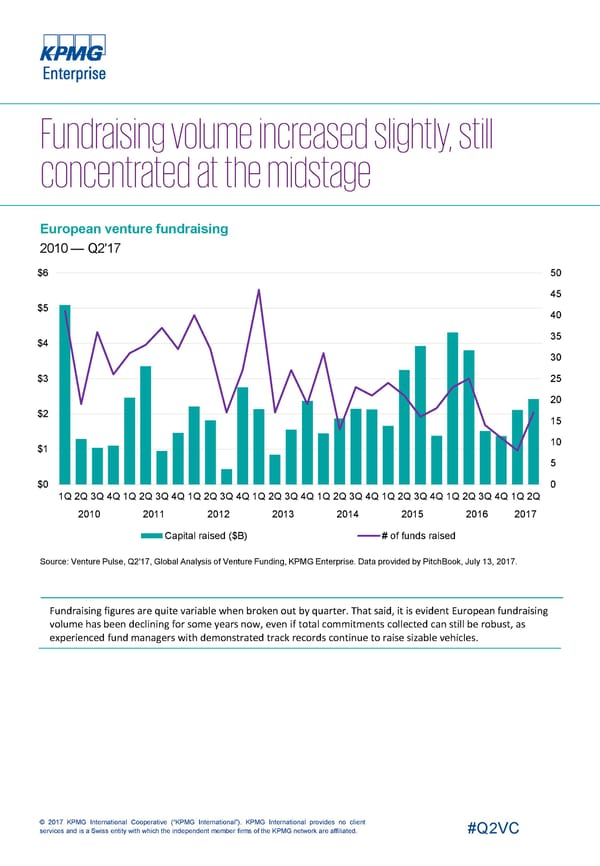

European venture fundraising 2010 — Q2'17 $6 50 45 $5 40 35 $4 30 $3 25 20 $2 15 10 $1 5 $0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Capital raised ($B) # of funds raised Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Fundraising figures are quite variable when broken out by quarter. That said, it is evident European fundraising volume has been declining for some years now, even if total commitments collected can still be robust, as experienced fund managers with demonstrated track records continue to raise sizable vehicles. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

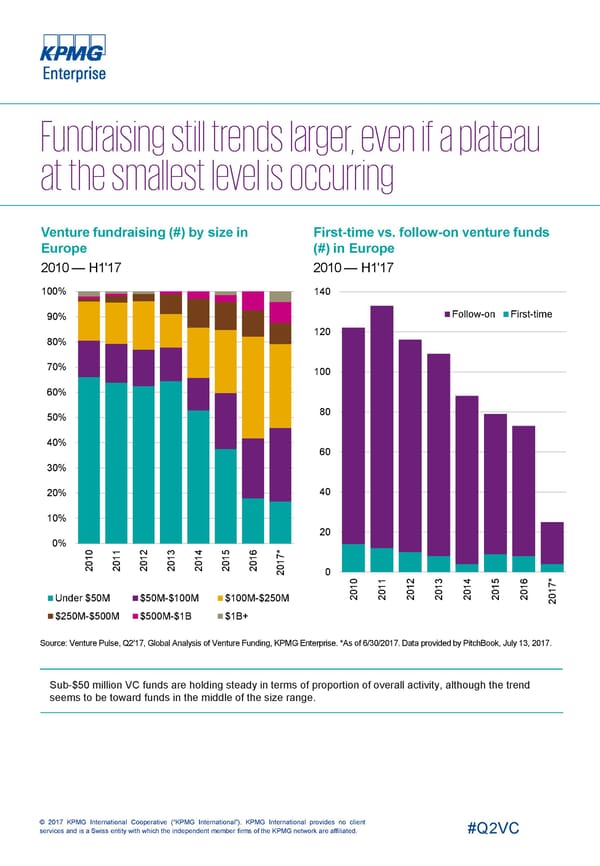

Venture fundraising (#) by size in First-time vs. follow-on venture funds Europe (#) in Europe 2010 — H1'17 2010 — H1'17 100% 140 Follow-on First-time 90% 120 80% 70% 100 60% 80 50% 40% 60 30% 20% 40 10% 20 0% 1 2 3 4 5 6 * 10 1 1 1 1 1 1 7 0 0 0 0 0 0 1 20 2 2 2 2 2 2 0 2 0 0 1 3 4 6 * 1 1 12 1 1 15 1 7 0 0 0 0 0 1 2 2 20 2 2 20 2 0 Under $50M $50M-$100M $100M-$250M 2 $250M-$500M $500M-$1B $1B+ Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook,July 13, 2017. Sub-$50 million VC funds are holding steady in terms of proportion of overall activity, although the trend seems to be toward funds in the middle of the size range. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

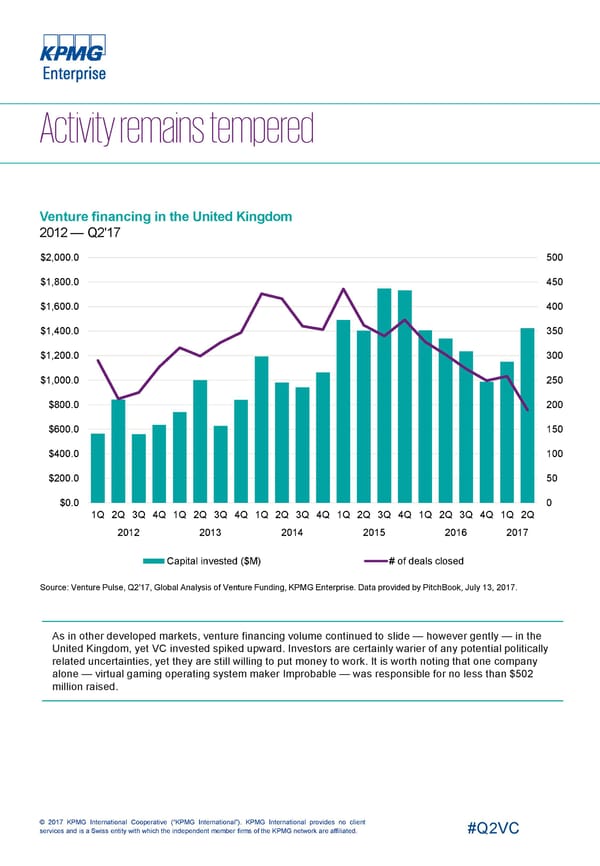

Venture financing in the United Kingdom 2012 — Q2'17 $2,000.0 500 $1,800.0 450 $1,600.0 400 $1,400.0 350 $1,200.0 300 $1,000.0 250 $800.0 200 $600.0 150 $400.0 100 $200.0 50 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. As in other developed markets, venture financing volume continued to slide — however gently — in the United Kingdom, yet VC invested spiked upward. Investors are certainly warier of any potential politically related uncertainties, yet they are still willing to put money to work. It is worth noting that one company alone — virtual gaming operating system maker Improbable — was responsible for no less than $502 million raised. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Venture financing in London 2012 — Q2'17 $1,200.0 300 $1,000.0 250 $800.0 200 $600.0 150 $400.0 100 $200.0 50 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. It’s important to note the effect of mega-rounds when examining venture activity within a given metropolis. London’s mammoth Q2’17 haul of $1.1 billion would have been $628 million when taking into account virtual gaming company Impropable’s $502 million financing. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

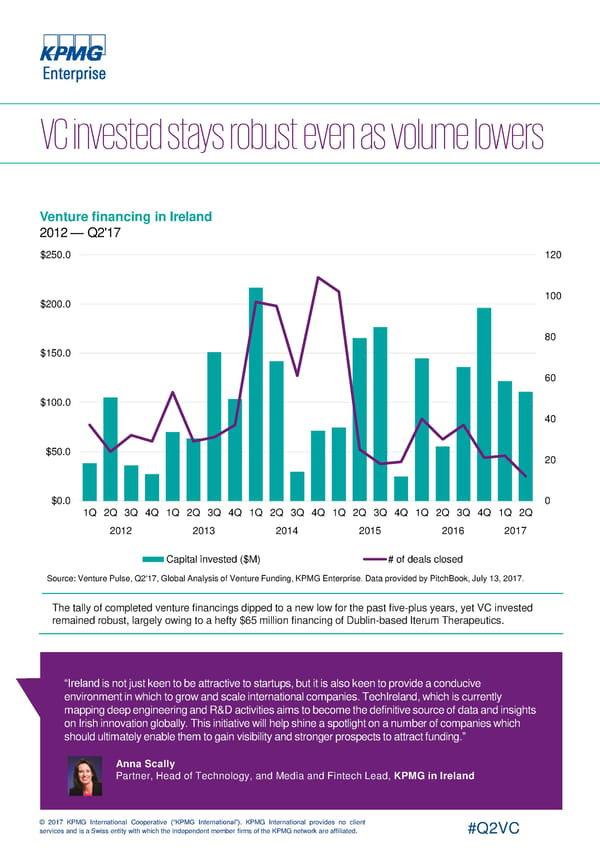

Venture financing in Ireland 2012 — Q2'17 $250.0 120 $200.0 100 80 $150.0 60 $100.0 40 $50.0 20 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. The tally of completed venture financings dipped to a new low for the past five-plus years, yet VC invested remained robust, largely owing to a hefty $65 million financing of Dublin-based Iterum Therapeutics. “Ireland is not just keen to be attractive to startups, but it is also keen to provide a conducive environment in which to grow and scale international companies. TechIreland, which is currently mapping deep engineering and R&D activities aims to become the definitive source of data and insights on Irish innovation globally. This initiative will help shine a spotlight on a number of companies which should ultimately enable them to gain visibility and stronger prospects to attract funding.” Anna Scally Partner, Head of Technology, and Media and Fintech Lead, KPMG in Ireland © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Venture financing in Germany 2012 — Q2'17 $2,500.0 140 120 $2,000.0 100 $1,500.0 80 60 $1,000.0 40 $500.0 20 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Venture sums invested on a quarterly basis in Germany continue to hold steady or even increase upwards, although activity continues to decline. This most recent decline is likely owing to timing more than anything else, although political uncertainty or the variability in economic health reports around the continent on the whole will likely continue to impact investor sentiment. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

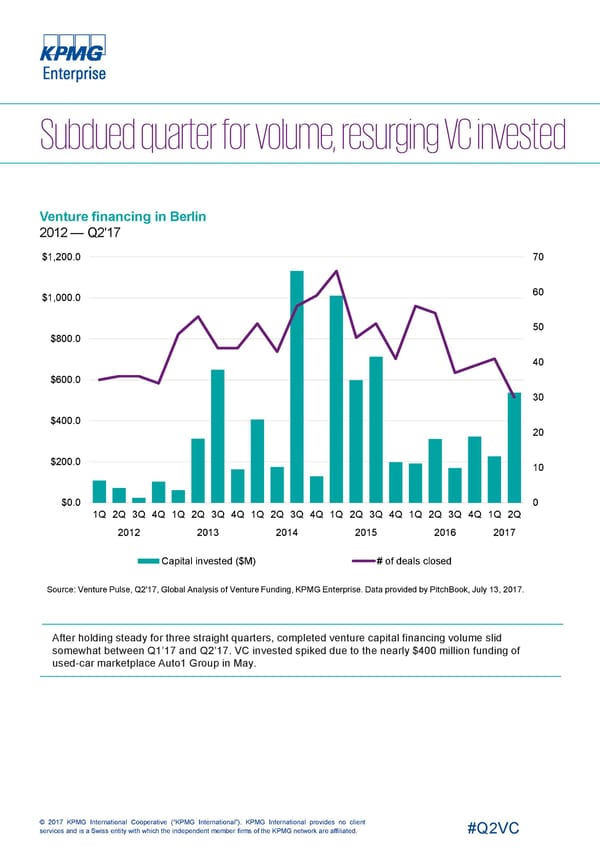

Venture financing in Berlin 2012 — Q2'17 $1,200.0 70 60 $1,000.0 50 $800.0 40 $600.0 30 $400.0 20 $200.0 10 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. After holding steady for three straight quarters, completed venture capital financing volume slid somewhat between Q1’17 and Q2’17. VC invested spiked due to the nearly $400 million funding of used-car marketplace Auto1 Group in May. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

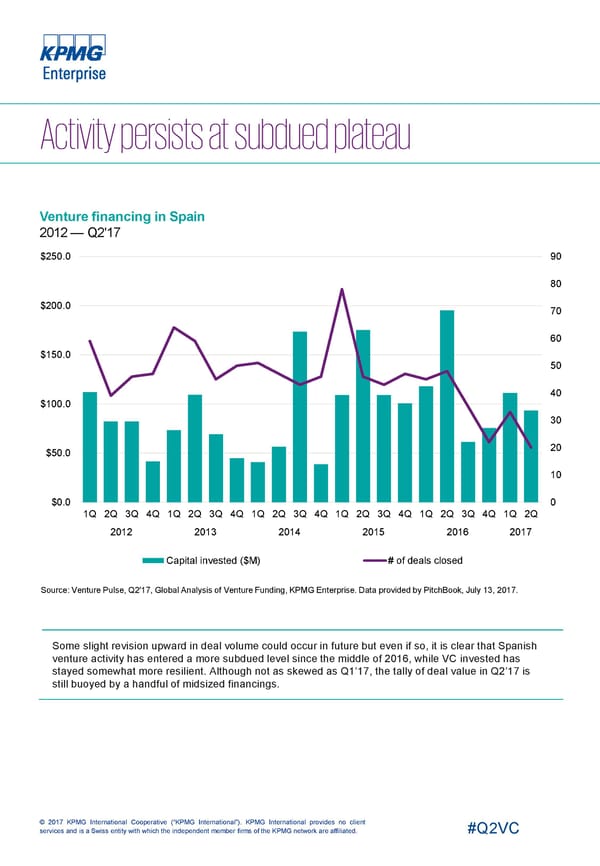

Venture financing in Spain 2012 — Q2'17 $250.0 90 80 $200.0 70 60 $150.0 50 40 $100.0 30 20 $50.0 10 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Some slight revision upward in deal volume could occur in future but even if so, it is clear that Spanish venture activity has entered a more subdued level since the middle of 2016, while VC invested has stayed somewhat more resilient. Although not as skewed as Q1’17, the tally of deal value in Q2’17 is still buoyed by a handful of midsized financings. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

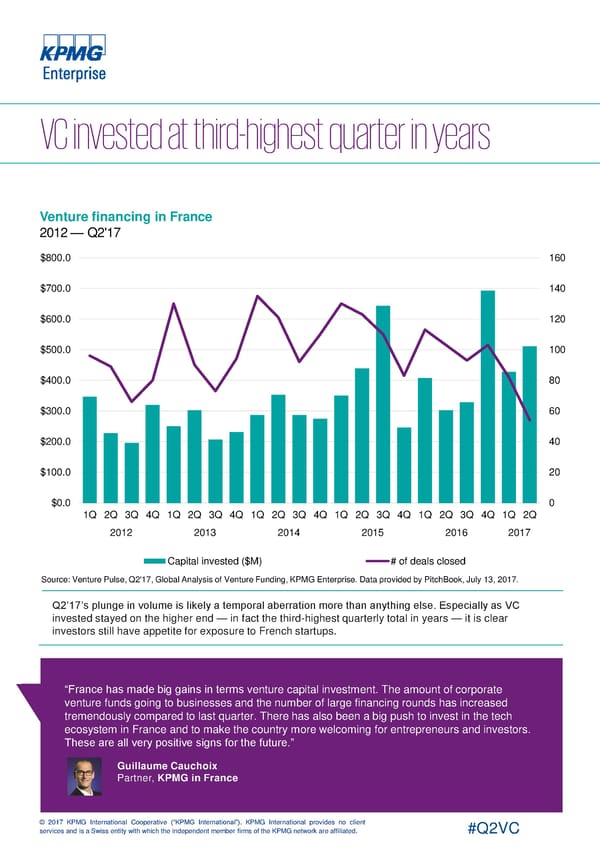

Venture financing in France 2012 — Q2'17 $800.0 160 $700.0 140 $600.0 120 $500.0 100 $400.0 80 $300.0 60 $200.0 40 $100.0 20 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Q2’17’s plunge in volume is likely a temporal aberration more than anything else. Especially as VC invested stayed on the higher end — in fact the third-highest quarterly total in years — it is clear investors still have appetite for exposure to French startups. “France has made big gains in terms venture capital investment. The amount of corporate venture funds going to businesses and the number of large financing rounds has increased tremendously compared to last quarter. There has also been a big push to invest in the tech ecosystem in France and to make the country more welcoming for entrepreneurs and investors. These are all very positive signs for the future.” Guillaume Cauchoix Partner, KPMG in France © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

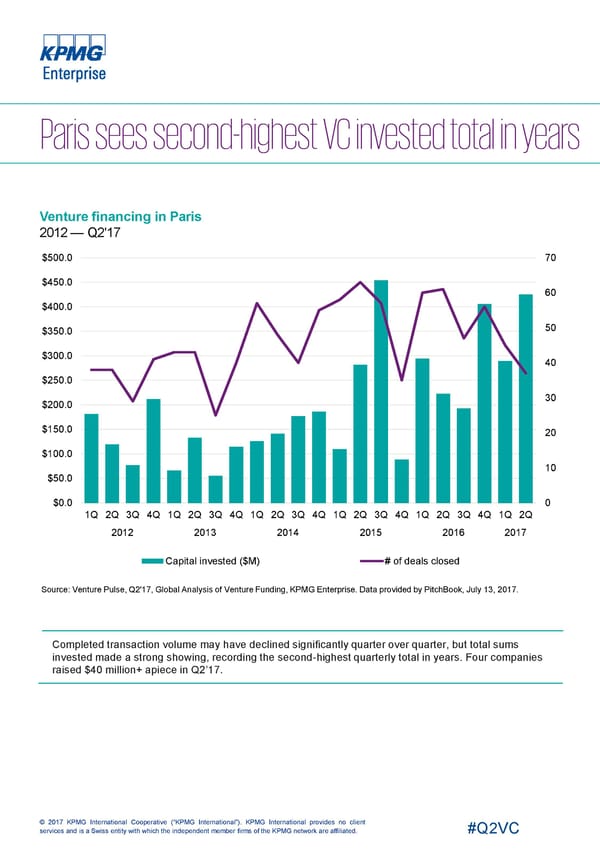

Venture financing in Paris 2012 — Q2'17 $500.0 70 $450.0 60 $400.0 50 $350.0 $300.0 40 $250.0 30 $200.0 $150.0 20 $100.0 10 $50.0 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Completed transaction volume may have declined significantly quarter over quarter, but total sums invested made a strong showing, recording the second-highest quarterly total in years. Four companies raised $40 million+ apiece in Q2’17. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

9 5 6 3 1 2 4 10 8 7 1 Improbable — $502M, London 6 Babylon Health — $60M, London Entertainment software Healthcare services Series B Series B 2 Auto1 Group — $397.6M, Berlin 7 Valens — $60M, Hod Hasharon Automotive Semiconductors late-stage VC late-stage VC 3 GammaDelta Therapeutics — $100M, 8 Shadow —$56.3M, Paris London Computer parts Biotechnology early-stage VC early-stage VC BIMA (Mobile Micro-insurance) — 4 Actility — $75M, Paris 9 $55.2M, Stockholm Application software Insurance software Series D Series C 5 Iterum Therapeutics — $65M, Dublin 10 Algolia —$53M, Paris Drug discovery Automation software Series B Series B Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC