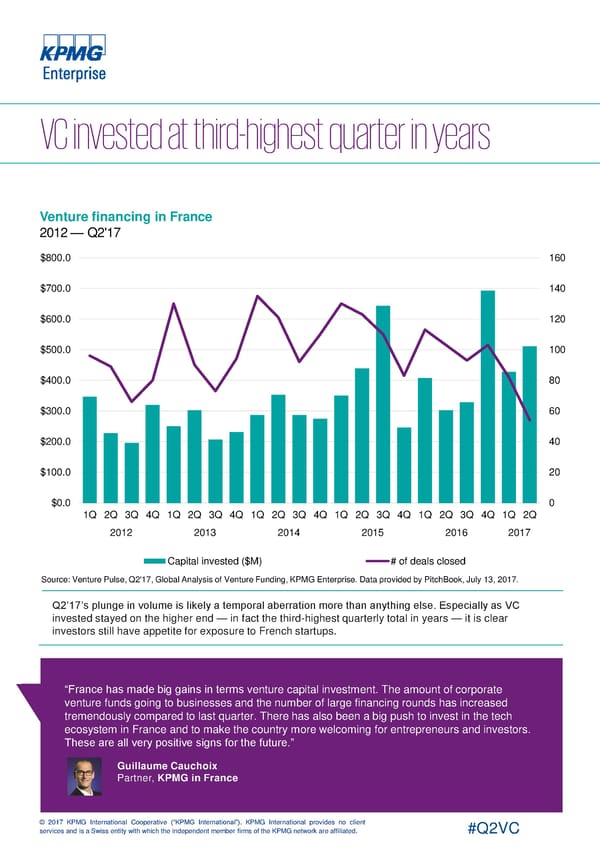

Venture financing in France 2012 — Q2'17 $800.0 160 $700.0 140 $600.0 120 $500.0 100 $400.0 80 $300.0 60 $200.0 40 $100.0 20 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Q2’17’s plunge in volume is likely a temporal aberration more than anything else. Especially as VC invested stayed on the higher end — in fact the third-highest quarterly total in years — it is clear investors still have appetite for exposure to French startups. “France has made big gains in terms venture capital investment. The amount of corporate venture funds going to businesses and the number of large financing rounds has increased tremendously compared to last quarter. There has also been a big push to invest in the tech ecosystem in France and to make the country more welcoming for entrepreneurs and investors. These are all very positive signs for the future.” Guillaume Cauchoix Partner, KPMG in France © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Europe Page 23 Page 25

Europe Page 23 Page 25