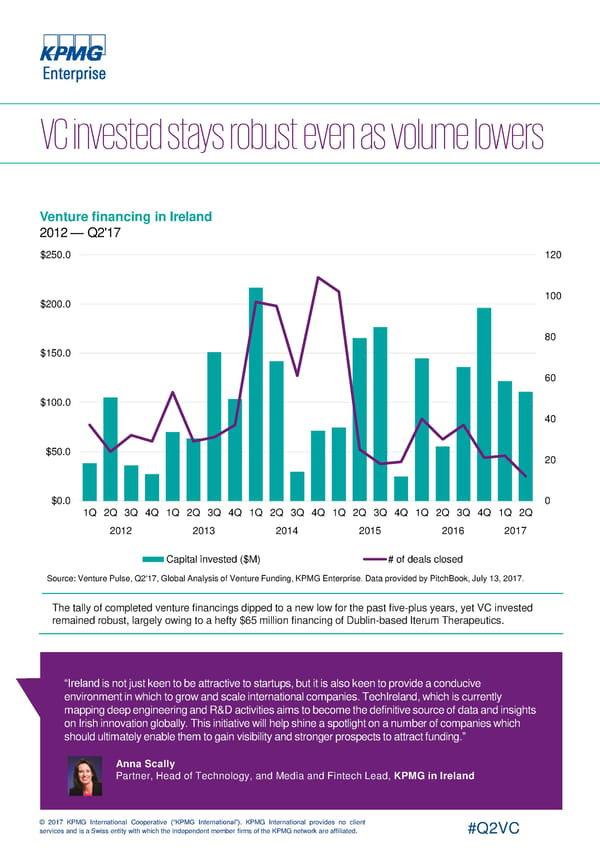

Venture financing in Ireland 2012 — Q2'17 $250.0 120 $200.0 100 80 $150.0 60 $100.0 40 $50.0 20 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. The tally of completed venture financings dipped to a new low for the past five-plus years, yet VC invested remained robust, largely owing to a hefty $65 million financing of Dublin-based Iterum Therapeutics. “Ireland is not just keen to be attractive to startups, but it is also keen to provide a conducive environment in which to grow and scale international companies. TechIreland, which is currently mapping deep engineering and R&D activities aims to become the definitive source of data and insights on Irish innovation globally. This initiative will help shine a spotlight on a number of companies which should ultimately enable them to gain visibility and stronger prospects to attract funding.” Anna Scally Partner, Head of Technology, and Media and Fintech Lead, KPMG in Ireland © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Europe Page 19 Page 21

Europe Page 19 Page 21