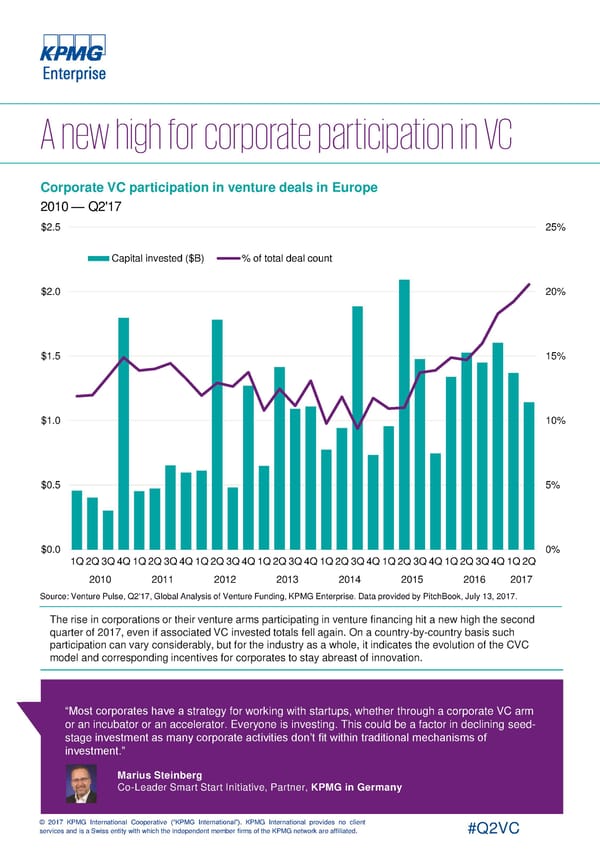

Corporate VC participation in venture deals in Europe 2010 — Q2'17 $2.5 25% Capital invested ($B) % of total deal count $2.0 20% $1.5 15% $1.0 10% $0.5 5% $0.0 0% 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. The rise in corporations or their venture arms participating in venture financing hit a new high the second quarter of 2017, even if associated VC invested totals fell again. On a country-by-country basis such participation can vary considerably, but for the industry as a whole, it indicates the evolution of the CVC model and corresponding incentives for corporates to stay abreast of innovation. “Most corporates have a strategy for working with startups, whether through a corporate VC arm or an incubator or an accelerator. Everyone is investing. This could be a factor in declining seed- stage investment as many corporate activities don’t fit within traditional mechanisms of investment.” Marius Steinberg Co-Leader Smart Start Initiative, Partner, KPMG in Germany © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Europe Page 9 Page 11

Europe Page 9 Page 11