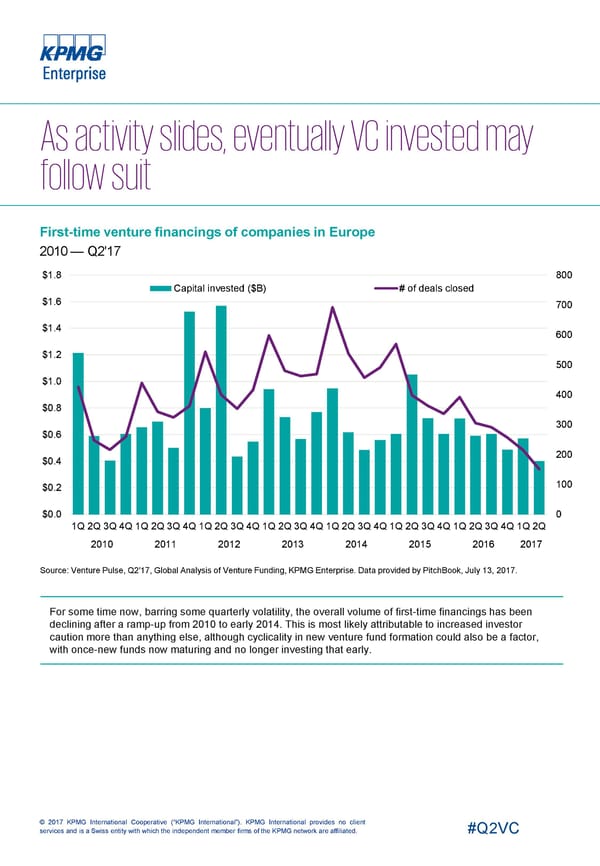

First-time venture financings of companies in Europe 2010 — Q2'17 $1.8 800 Capital invested ($B) # of deals closed $1.6 700 $1.4 600 $1.2 500 $1.0 400 $0.8 300 $0.6 200 $0.4 100 $0.2 $0.0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. For some time now, barring some quarterly volatility, the overall volume of first-time financings has been declining after a ramp-up from 2010 to early 2014. This is most likely attributable to increased investor caution more than anything else, although cyclicality in new venture fund formation could also be a factor, with once-new funds now maturing and no longer investing that early. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Europe Page 10 Page 12

Europe Page 10 Page 12