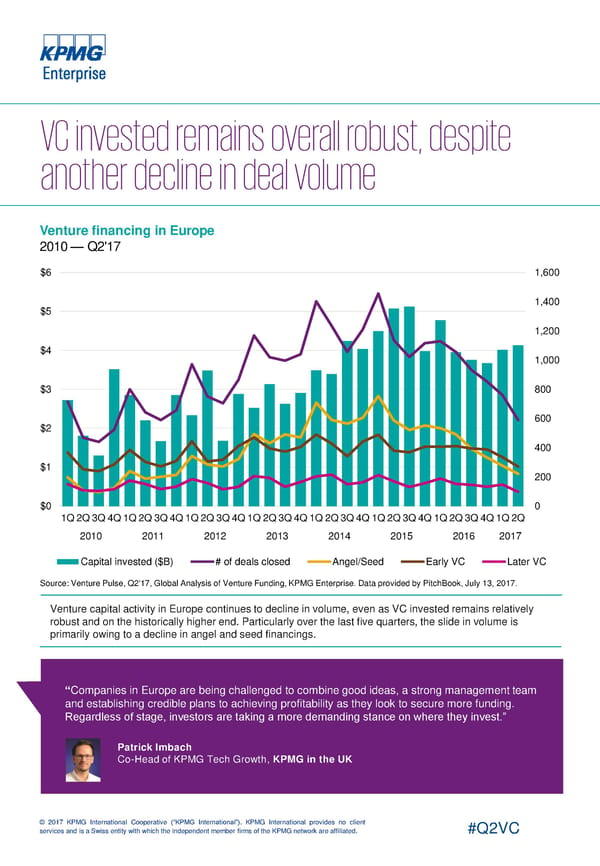

Venture financing in Europe 2010 — Q2'17 $6 1,600 $5 1,400 1,200 $4 1,000 $3 800 $2 600 400 $1 200 $0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Capital invested ($B) # of deals closed Angel/Seed Early VC Later VC Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Venture capital activity in Europe continues to decline in volume, even as VC invested remains relatively robust and on the historically higher end. Particularly over the last five quarters, the slide in volume is primarily owing to a decline in angel and seed financings. “Companies in Europe are being challenged to combine good ideas, a strong management team and establishing credible plans to achieving profitability as they look to secure more funding. Regardless of stage, investors are taking a more demanding stance on where they invest.” Patrick Imbach Co-Head of KPMG Tech Growth, Patrick Imbach KPMG in the UK Co-Head of KPMG Tech Growth, KPMG in the UK © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Europe Page 4 Page 6

Europe Page 4 Page 6