Asia

Asia VC market awash with money

In Q2'17 VC-backed companies in the Asia region raised across 315 deals

Venture capital investment in Asia rose sharply during the second quarter compared to Q1’17, bolstered by two mega-rounds in China. Despite the significant increase in funding, the number of deals declined, likely a result of ongoing investor caution. mega-deals bring roar back into the Asia VC market Beijing-based ride-hailing giant Didi Chuxing raised $5.5-billion in Q2’17, in the largest private venture funding round ever for a technology company. Another startup, Toutiao, became China’s most valuable media company almost overnight after Sequoia Capital and CCB International invested $1 billion. Asia also saw a significant number of $100 million+ funding rounds during Q2’17, in what may be a turning point for regional investment. In addition to a number of China-based companies, Singapore- based Sea raised $550 million, while India-based OYO Rooms raised $250 million. Corporate interest high across Asia In recent quarters, a greater number of corporates have been making VC investments in Asia. Particularly in Japan, where CEOs of traditional companies have recognized the imperative to innovate in order to remain relevant, corporate venturing remains an important part of the overall ecosystem. Increased corporate involvement in Asia has been especially noticeable in the autotech and healthcare sectors. Both high tech and simple tech solutions gaining traction During Q2’17, the hottest sectors of VC investment in Asia were artificial intelligence, robotics, fintech, edtech and healthtech, although interest in cloud and infrastructure services also picked up speed. At the same time, companies with simple business models also attracted significant VC investment, including bikesharing start-ups Mobike and Ofo. In June, Mobike raised $600 million, while two-year-old Ofo is currently valued at approximately $2 billion. While these types of companies continue to burn cash in a race to acquire market share, it remains to be seen if their business models will be viable long term. Startups moving up the value chain There has been a growing trend in 2017 associated with startups looking to move up the value chain by investing heavily in training and customer service. Didi Chuxing, for example, now requires all of its drivers to learn English. Many customer-focused startups recognize that in order to make money, they need to charge more — but to charge more, they need to enhance their services. Fintech interest remains high in China and Hong Kong In China and Hong Kong, fintech remains a key area of investor interest despite a dip in funding in Q2’17. This interest has focused on front office and customer experience improvements as companies in the region remain growth focused. This is unique compared to other regions, where fintech investment often focuses on achieving back office efficiencies. Government and middle class investors driving activity in China The government continued to drive innovation in China in Q2’17. During the quarter, state-owned company China Aerospace Science and Technology Corporation (CASC) announced a $22 billion fund to invest in new technologies in partnership with other state-owned organizations. The government also implemented foreign currency controls to encourage investment abroad in specific areas where there is great potential for technologies to benefit the Chinese economy.12 As personal wealth has grown in China, many in China’s emerging middle class have also started to pool their money into small VC funds — adding to the money available in the market. 12 http://www.opengovasia.com/articles/7614-chinese-state-owned-enterprises-form-usd-22-billion-fund-to-invest-in-emerging-strategic-industries © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

VC market in India sees significant shift Following the Flipkart deal in Q1’17, India saw a major turnaround in VC activity during Q2’17. Investor interest has skyrocketed, particularly for deep tech solutions. A number of late-stage startups also began to consider acquiring early-stage companies as a way to quickly plug gaps in their portfolios. From an exit perspective, India is poised to see a couple of IPOs in the tech space early in Q3. Funding has also become more readily available, with some startup founders in India becoming angel investors themselves. During Q2’17, the government of India also announced a goods and services tax (GST) in a major tax policy shift. This is causing some concern for investors and companies of all levels. The impact of this development will likely become clearer over the next quarter.13 Trends to watch for in Asia Venture capital activity is posed to remain strong in Asia, with deep tech, autotech and healthtech continuing to be major sectors of interest. Heading into Q3, however, investors looking at China will need to keep a keen eye on the National Congress of the Communist Party in Beijing as the government’s new priorities will be set. The outcomes of this congress may have a significant impact on VC investment trends in 2018. 13 http://www.bbc.com/news/world-asia-india-40453774 © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

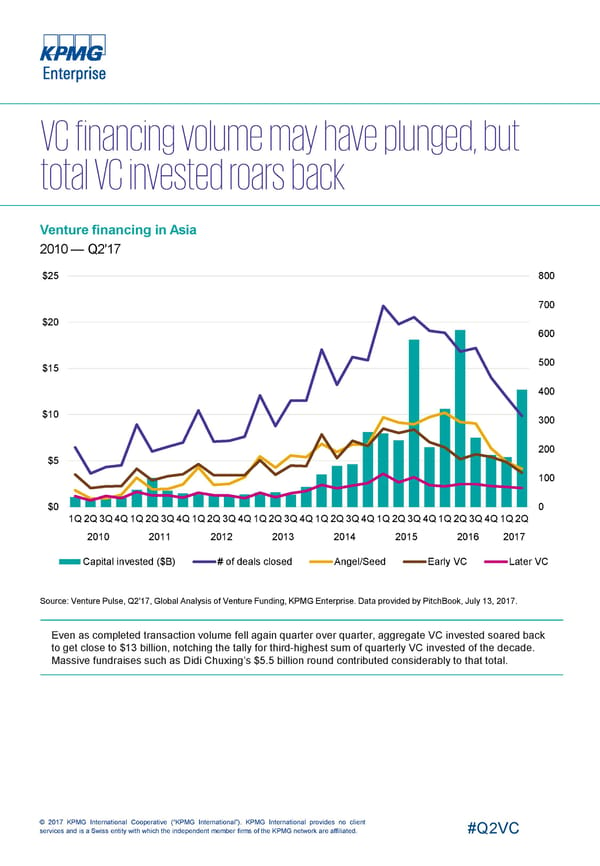

Venture financing in Asia 2010 — Q2'17 $25 800 700 $20 600 500 $15 400 $10 300 200 $5 100 $0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Capital invested ($B) # of deals closed Angel/Seed Early VC Later VC Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Even as completed transaction volume fell again quarter over quarter, aggregate VC invested soared back to get close to $13 billion, notching the tally for third-highest sum of quarterly VC invested of the decade. Massive fundraises such as Didi Chuxing’s $5.5 billion round contributed considerably to that total. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

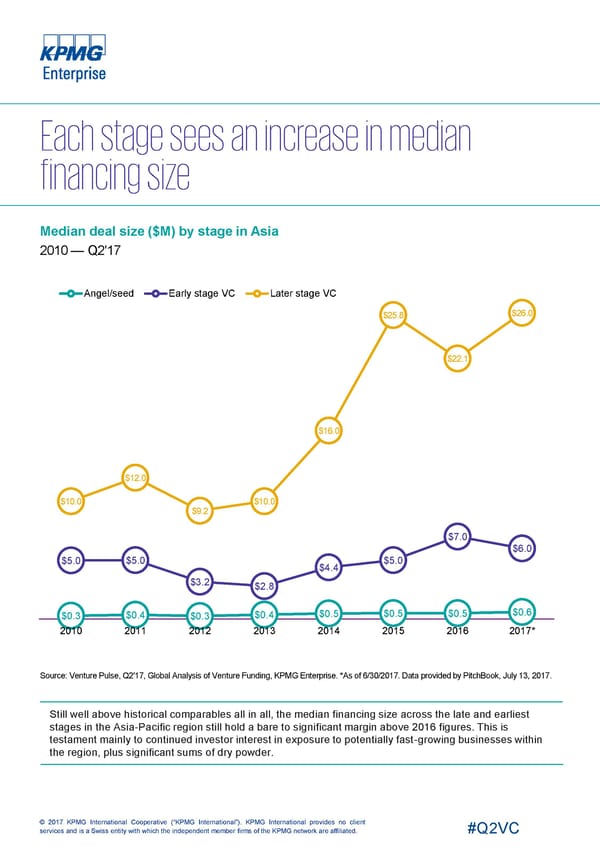

Median deal size ($M) by stage in Asia 2010 — Q2'17 Angel/seed Early stage VC Later stage VC $26.0 $25.8 $22.1 $16.0 $12.0 $10.0 $10.0 $9.2 $7.0 $6.0 $5.0 $5.0 $5.0 $4.4 $3.2 $2.8 $0.6 $0.5 $0.5 $0.5 $0.3 $0.4 $0.4 $0.3 2010 2011 2012 2013 2014 2015 2016 2017* Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook,July 13, 2017. Still well above historical comparables all in all, the median financing size across the late and earliest stages in the Asia-Pacific region still hold a bare to significant margin above 2016 figures. This is testament mainly to continued investor interest in exposure to potentially fast-growing businesses within the region, plus significant sums of dry powder. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Median deal size ($M) by series in Asia 2010 — H1'17 Seed Series A Series B $17.0 $16.0 $15.0 $15.0 $10.0 $8.0 $8.0 $7.7 $5.2 $5.0 $4.9 $5.0 $4.4 $3.5 $3.4 $2.5 $0.8 $0.4 $0.5 $0.5 $0.3 $0.4 $0.3 $0.1 2010 2011 2012 2013 2014 2015 2016 2017* Series C Series D+ $100 $100 $59 $50 $50 $36 $32 $31 $31 $30 $26 $19 $17 $20 $17 $15 2010 2011 2012 2013 2014 2015 2016 2017* Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. Note: Select figures are rounded for legibility. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

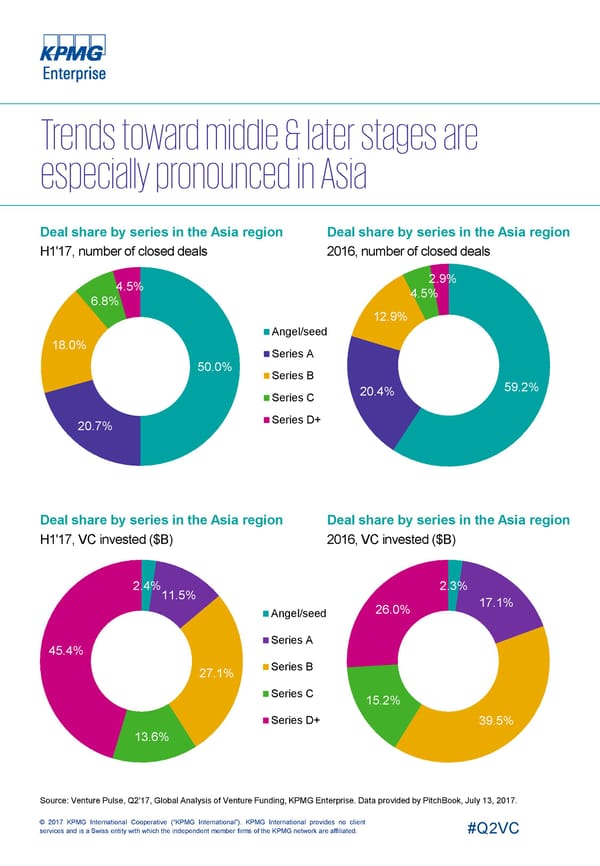

Deal share by series in the Asia region Deal share by series in the Asia region H1'17, number of closed deals 2016, number of closed deals 2.9% 4.5% 4.5% 6.8% 12.9% Angel/seed 18.0% Series A 50.0% Series B 59.2% 20.4% Series C Series D+ 20.7% Deal share by series in the Asia region Deal share by series in the Asia region H1'17, VC invested ($B) 2016, VC invested ($B) 2.4% 2.3% 11.5% 17.1% 26.0% Angel/seed Series A 45.4% Series B 27.1% Series C 15.2% Series D+ 39.5% 13.6% Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

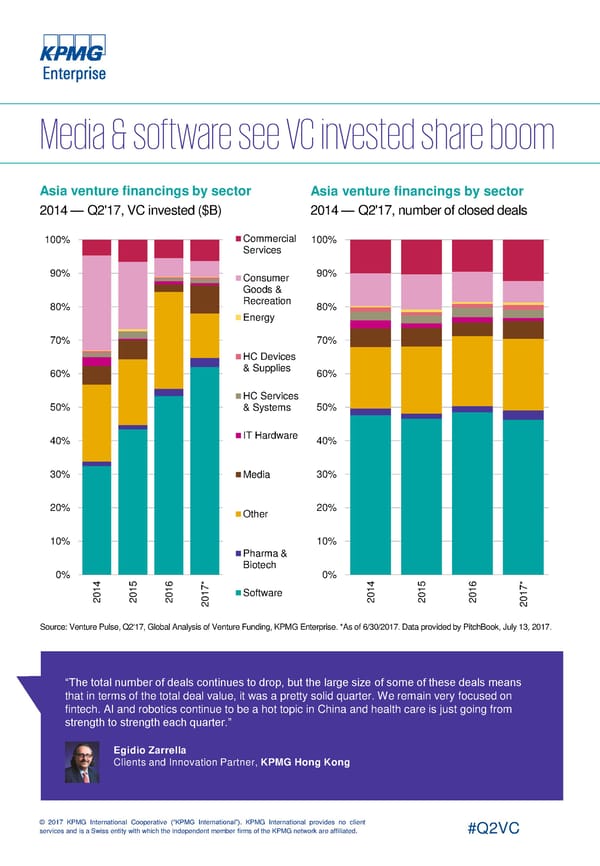

Asia venture financings by sector Asia venture financings by sector 2014 — Q2'17, VC invested ($B) 2014 — Q2'17, number of closed deals 100% Commercial 100% Services 90% Consumer 90% Goods & 80% Recreation 80% Energy 70% 70% HC Devices 60% & Supplies 60% HC Services 50% & Systems 50% 40% IT Hardware 40% 30% Media 30% 20% Other 20% 10% 10% Pharma & 0% Biotech 0% 4 5 6 * 4 5 6 * 1 1 1 7 1 1 1 7 0 0 0 1 Software 0 0 0 1 2 2 2 0 2 2 2 0 2 2 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook,July 13, 2017. “The total number of deals continues to drop, but the large size of some of these deals means that in terms of the total deal value, it was a pretty solid quarter. We remain very focused on fintech. AI and robotics continue to be a hot topic in China and health care is just going from strength to strength each quarter.” Patrick Imbach Co-Head of KPMG Tech Growth, Egidio Zarrella Clients and Innovation Partner, KPMG Hong Kong KPMG in the UK © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

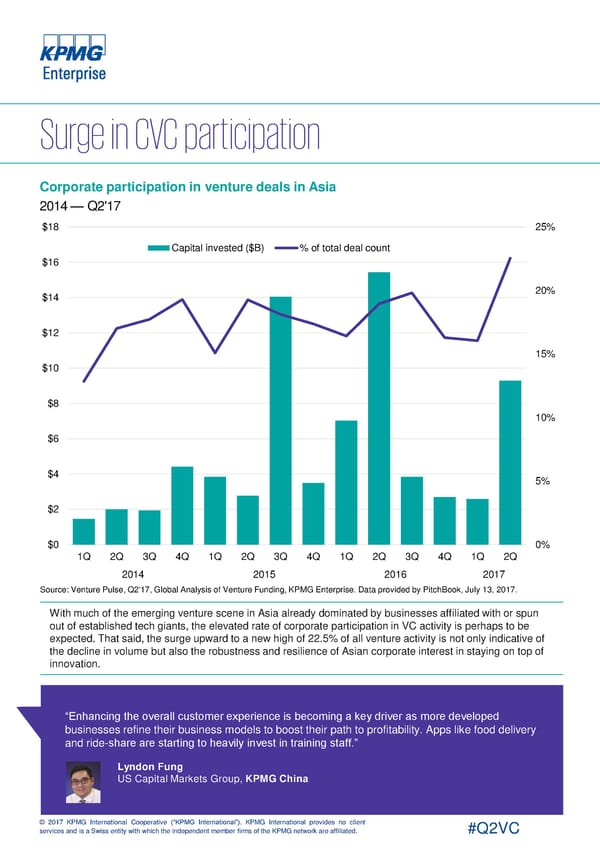

Corporate participation in venture deals in Asia 2014 — Q2'17 $18 25% Capital invested ($B) % of total deal count $16 $14 20% $12 15% $10 $8 10% $6 $4 5% $2 $0 0% 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2014 2015 2016 2017 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. With much of the emerging venture scene in Asia already dominated by businesses affiliated with or spun out of established tech giants, the elevated rate of corporate participation in VC activity is perhaps to be expected. That said, the surge upward to a new high of 22.5% of all venture activity is not only indicative of the decline in volume but also the robustness and resilience of Asian corporate interest in staying on top of innovation. “Enhancing the overall customer experience is becoming a key driver as more developed businesses refine their business models to boost their path to profitability. Apps like food delivery and ride-share are starting to heavily invest in training staff.” Lyndon Fung US Capital Markets Group, KPMG China © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

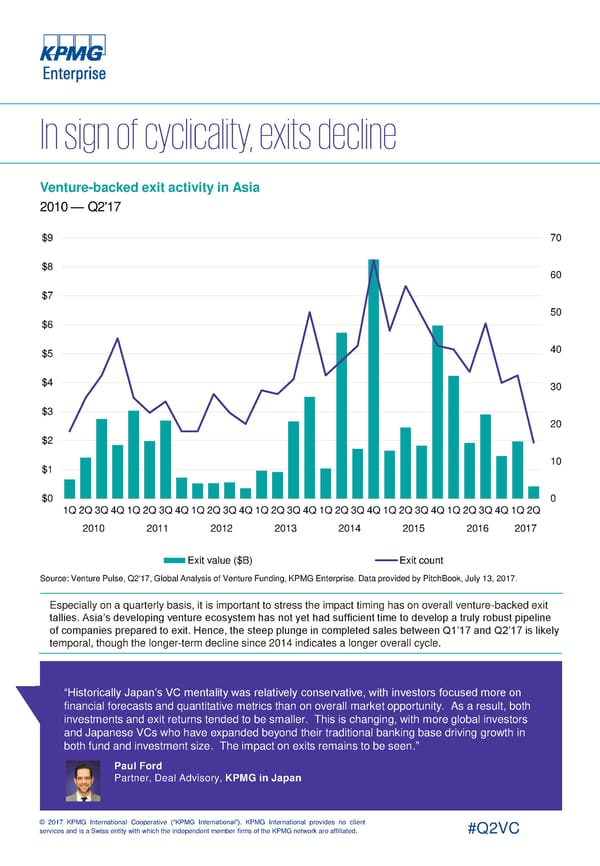

Venture-backed exit activity in Asia 2010 — Q2'17 $9 70 $8 60 $7 50 $6 $5 40 $4 30 $3 20 $2 $1 10 $0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Exit value ($B) Exit count Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Especially on a quarterly basis, it is important to stress the impact timing has on overall venture-backed exit tallies. Asia’s developing venture ecosystem has not yet had sufficient time to develop a truly robust pipeline of companies prepared to exit. Hence, the steep plunge in completed sales between Q1’17 and Q2’17 is likely temporal, though the longer-term decline since 2014 indicates a longer overall cycle. “Historically Japan’s VC mentality was relatively conservative, with investors focused more on financial forecasts and quantitative metrics than on overall market opportunity. As a result, both investments and exit returns tended to be smaller. This is changing, with more global investors and Japanese VCs who have expanded beyond their traditional banking base driving growth in both fund and investment size. The impact on exits remains to be seen.” Paul Ford Patrick Imbach Partner, Deal Advisory, KPMG in Japan Co-Head of KPMG Tech Growth, KPMG in the UK © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

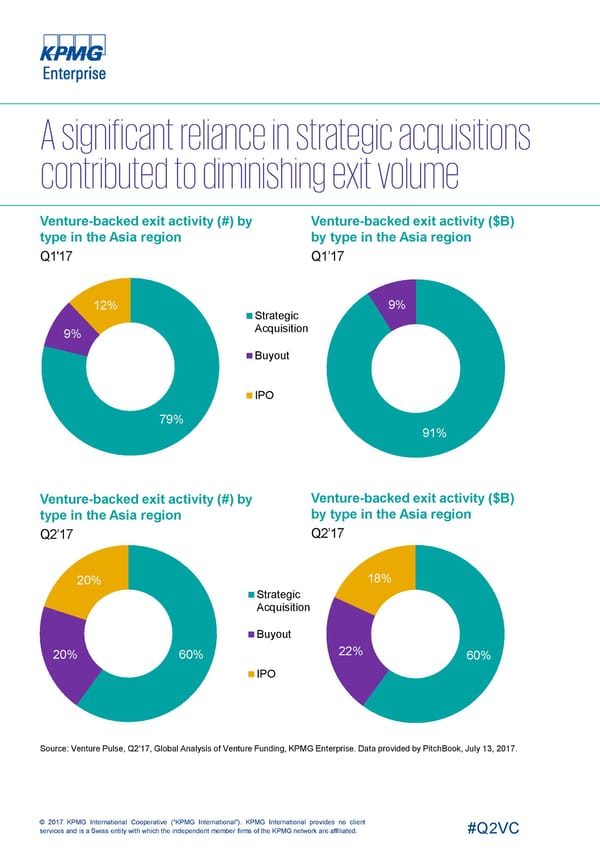

Venture-backed exit activity (#) by Venture-backed exit activity ($B) type in the Asia region by type in the Asia region Q1'17 Q1’17 12% 9% Strategic Acquisition 9% Buyout IPO 79% 91% Venture-backed exit activity (#) by Venture-backed exit activity ($B) type in the Asia region by type in the Asia region Q2’17 Q2’17 18% 20% Strategic Acquisition Buyout 22% 20% 60% 60% IPO Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

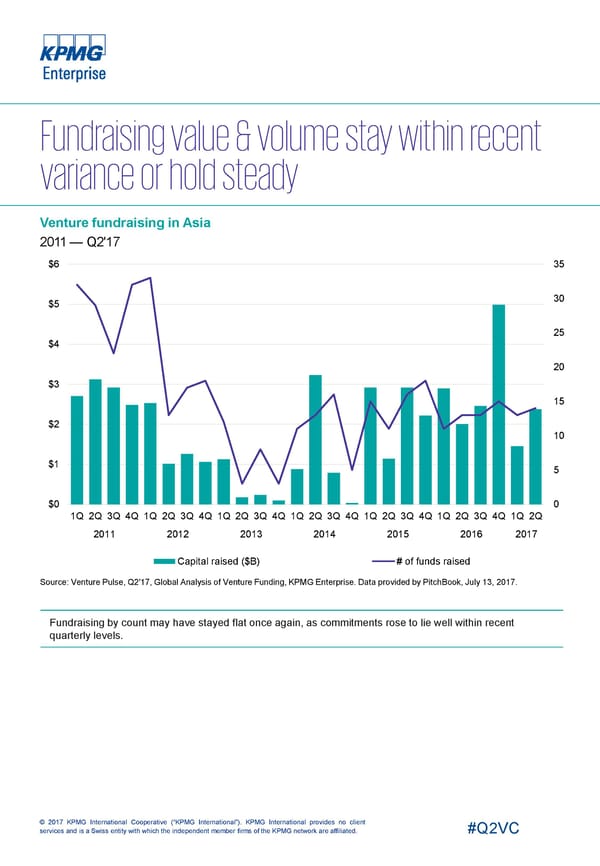

Venture fundraising in Asia 2011 — Q2'17 $6 35 30 $5 25 $4 20 $3 15 $2 10 $1 5 $0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2011 2012 2013 2014 2015 2016 2017 Capital raised ($B) # of funds raised Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Fundraising by count may have stayed flat once again, as commitments rose to lie well within recent quarterly levels. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

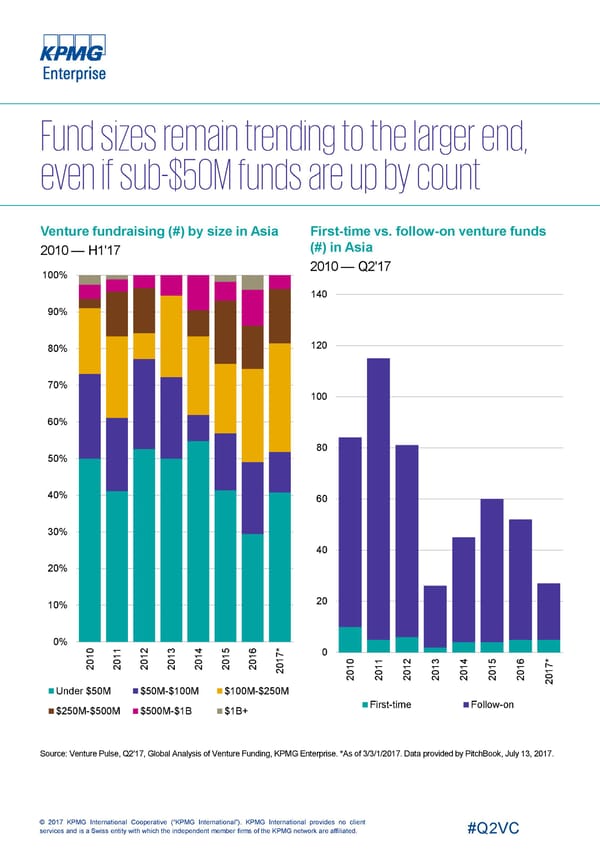

Venture fundraising (#) by size in Asia First-time vs. follow-on venture funds (#) in Asia 2010 — H1'17 2010 — Q2'17 100% 140 90% 120 80% 70% 100 60% 80 50% 40% 60 30% 40 20% 20 10% 0% 0 1 2 3 4 5 6 * 7 0 1 1 1 1 1 1 1 0 0 0 0 0 0 0 1 0 1 2 3 4 5 6 * 2 2 2 2 2 2 2 0 1 1 1 1 1 1 1 7 2 0 0 0 0 0 0 0 1 2 2 2 2 2 2 2 0 2 Under $50M $50M-$100M $100M-$250M First-time Follow-on $250M-$500M $500M-$1B $1B+ Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 3/3/1/2017. Data provided by PitchBook, July 13, 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

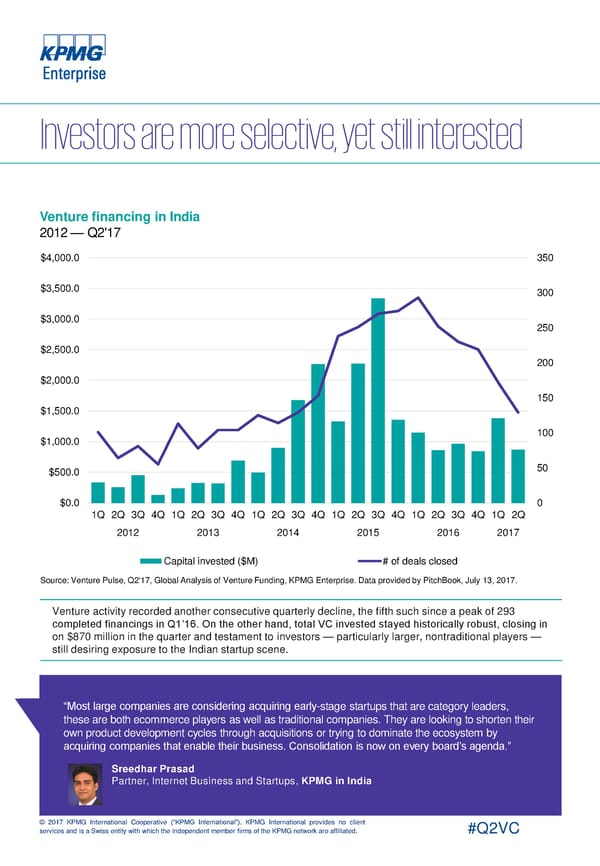

Venture financing in India 2012 — Q2'17 $4,000.0 350 $3,500.0 300 $3,000.0 250 $2,500.0 200 $2,000.0 150 $1,500.0 $1,000.0 100 $500.0 50 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Venture activity recorded another consecutive quarterly decline, the fifth such since a peak of 293 completed financings in Q1’16. On the other hand, total VC invested stayed historically robust, closing in on $870 million in the quarter and testament to investors — particularly larger, nontraditional players — still desiring exposure to the Indian startup scene. “Most large companies are considering acquiring early-stage startups that are category leaders, these are both ecommerce players as well as traditional companies. They are looking to shorten their own product development cycles through acquisitions or trying to dominate the ecosystem by acquiring companies that enable their business. Consolidation is now on every board’s agenda.” Patrick Imbach Sreedhar Prasad Partner, Internet Business and Startups, KPMG in India Co-Head of KPMG Tech Growth, KPMG in the UK © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

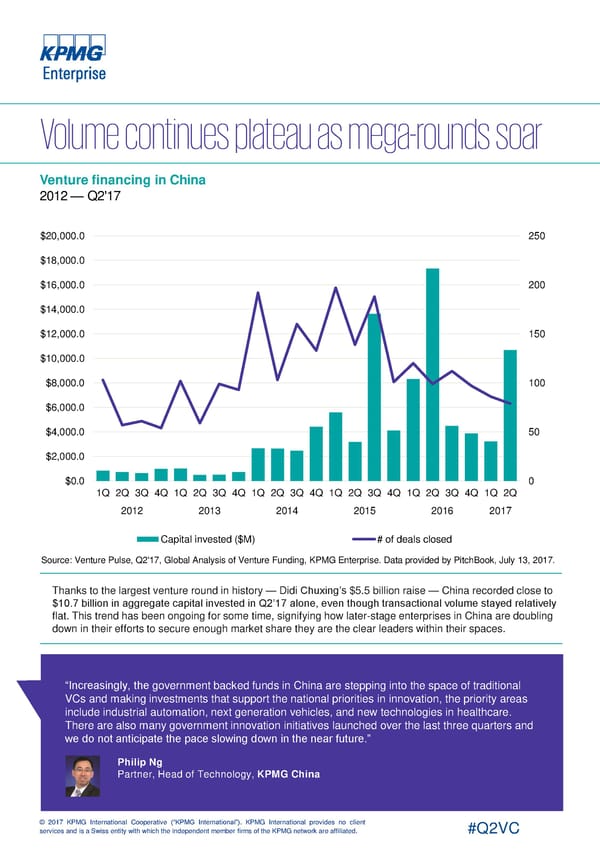

Venture financing in China 2012 — Q2'17 $20,000.0 250 $18,000.0 $16,000.0 200 $14,000.0 $12,000.0 150 $10,000.0 $8,000.0 100 $6,000.0 $4,000.0 50 $2,000.0 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Thanks to the largest venture round in history — Didi Chuxing’s $5.5 billion raise — China recorded close to $10.7 billion in aggregate capital invested in Q2’17 alone, even though transactional volume stayed relatively flat. This trend has been ongoing for some time, signifying how later-stage enterprises in China are doubling down in their efforts to secure enough market share they are the clear leaders within their spaces. “Increasingly, the government backed funds in China are stepping into the space of traditional VCs and making investments that support the national priorities in innovation, the priority areas include industrial automation, next generation vehicles, and new technologies in healthcare. There are also many government innovation initiatives launched over the last three quarters and we do not anticipate the pace slowing down in the near future.” Patrick Imbach Philip Ng Co-Head of KPMG Tech Growth, Partner, Head of Technology, KPMG China KPMG in the UK © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

8 1 5 2 6 3 7 10 9 4 1 Didi — $5,500M, Beijing 6 Guazi.com — $400M, Beijing Platform software Transportation late-stage VC Series B 2 Toutiao — $1,000M, Beijing 7 OYO Rooms — $250M, Gurgaon Information services Hotels Series D late-stage VC 3 Mobike — $600M, Beijing* 8 Mobvoi — $180M, Beijing Transportation Electronics (B2C) Series E Series D 4 Sea — $550M, Singapore 9 Souche.com — $180M, Hangzhou Social platform software Transportation late-stage VC Series D 5 Ofo—$450M, Beijing 10 Mychebao—$174M, Nanjing Transportation Automotive Series D Series C Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. *Note: In the prior edition of the Venture Pulse, Mobike’s Singapore location was identified as the outlet wherein its Q1’17 round was raised, given the purpose of the funds was explicitly for expansion in the Singapore and adjacent markets. This subsequent financing, as best as can be determined, is for overall purposes, hence the location is determined as Mobike’s official headquarters. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Contact us: Brian Hughes Arik Speier Co-Leader, KPMG Enterprise Co-Leader, KPMG Enterprise Innovative Startups Network Innovative Startups Network E: [email protected] E: [email protected] © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

About KPMG Enterprise You know KPMG, you might not know KPMG Enterprise. KPMG Enterprise advisers in member firms around the world are dedicated to working with businesses like yours. Whether you’re an entrepreneur looking to get started, an innovative, fast growing company, or an established company looking to an exit, KPMG Enterprise advisers understand what is important to you and can help you navigate your challenges — no matter the size or stage of your business. You gain access to KPMG’s global resources through a single point of contact — a trusted adviser to your company. It’s a local touch with a global reach. The KPMG Enterprise Global Network for Innovative Startups has extensive knowledge and experience working with the startup ecosystem. Whether you are looking to establish your operations, raise capital, expand abroad, or simply comply with regulatory requirements — we can help. From seed to speed, we’re here throughout your journey. The VC market globally is dynamic and ever-changing. Technology companies looking to attract investment reflect a myriad of sectors, products and solutions. In today’s technology-centric society, however, one sector stands apart: Fintech. Globally, fintech innovators are changing the very foundation of how business works and are enabling incumbent financial institutions. Every day, new fintech companies are finding ways to make banking, financial and insurance services more personalized, smarter and faster. Fintech solutions have the potential to reach every market sector, business, and consumer on the planet. The opportunities fintech offers are significant, and investors know it. That’s why KPMG International created the Pulse of Fintech Report. Every quarter, KPMG International brings you insights on the fintech deals and trends making headlines. The Q2'17 report will be released soon. If you wish to join the Pulse of Fintech subscription list, contact us at [email protected]. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

We acknowledge the contribution of the following individuals who assisted in the development of this publication: Jonathan Lavender, Global Chairman, KPMG Enterprise, KPMG International Brian Hughes, Co-Leader, KPMG Enterprise Innovative Startups Network, and National Co-Lead Partner, KPMG Venture Capital Practice, KPMG in the US Arik Speier, Co-Leader, KPMG Enterprise Innovative Startups Network, and Head of Technology, KPMG in Israel Andre Guedel, Head of Business Development, KPMG in Switzerland Anna Scally, Partner, Head of Technology and Media and Fintech Lead, KPMG in Ireland Conor Moore, National Co-Lead Partner, KPMG Venture Capital Practice, KPMG in the US Egidio Zarrella, Clients and Innovation Partner, KPMG Hong Kong Gary Silberg, Americas Head of Automotive and Partner, KPMG in the US Guillaume Cauchoix, Partner, KPMG in France Lindsay Hull, Associate Director, KPMG Enterprise Global Innovative Startups Network, KPMG in the US Lyndon Fung, US Capital Markets Group, KPMG China Marius Sternberg, Partner, KPMG in Germany Melany Eli, Global Head of Marketing and Communications, KPMG Enterprise, KPMG International Patrick Imbach, Co-Head of KPMG Tech Growth, KPMG in the UK Paul Ford, Partner, Deal Advisory, KPMG in Japan Philip Ng, Head of Technology, KPMG China Sreedhar Prasad, Partner, Internet Business and Startups, KPMG in India Sunil Mistry, Partner, KPMG Enterprise, Technology, Media and Telecommunications, KPMG in Canada © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

KPMG has switched to PitchBook as the provider of venture data for the Venture Pulse report. Due to differing methodologies between data providers, there may be discrepancies between this and prior editions of the Venture Pulse report. Please note that the MESA and Africa regions are NOT broken out in this report. Accordingly, if you add up the Americas, Asia-Pacific and Europe regional totals, they will not match the global total, as the global total takes into account those other regions. Those specific regions were not highlighted in this report due to a paucity of datasets and verifiable trends. Fundraising PitchBook defines venture capital funds as pools of capital raised for the purpose of investing in the equity of startup companies. In addition to funds raised by traditional venture capital firms, PitchBook also includes funds raised by any institution with the primary intent stated above. Funds identified as growth- stage vehicles are classified as PE funds and are not included in this report. A fund’s location is determined by the country in which the fund is domiciled, if that information is not explicitly known, the HQ country of the fund’s general partner is used. Only funds based in the US that have held their final close are included in the fundraising numbers. The entirety of a fund’s committed capital is attributed to the year of the final close of the fund. Interim close amounts are not recorded in the year of the interim close. Deals PitchBook includes equity investments into startup companies from an outside source. Investment does not necessarily have to be taken from an institutional investor. This can include investment from individual angel investors, angel groups, seed funds, venture capital firms, corporate venture firms, and corporate investors. Investments received as part of an accelerator program are not included, however, if the accelerator continues to invest in follow-on rounds, those further financings are included. All financings are of companies headquartered in the US. Angel/seed: PitchBook defines financings as angel rounds if there are no PE or VC firms involved in the company to date and it cannot determine if any PE or VC firms are participating. In addition, if there is a press release that states the round is an angel round, it is classified as such. If angels are the only investors, then a round is only marked as seed if it is explicitly stated. Early-stage: Rounds are generally classified as Series A or B (which PitchBook typically aggregates together as early-stage) either by the series of stock issued in the financing or, if that information is unavailable, by a series of factors including: the age of the company, prior financing history, company status, participating investors, and more. Late-stage: Rounds are generally classified as Series C or D or later (which PitchBook typically aggregates together as late-stage) either by the series of stock issued in the financing or, if that information is unavailable, by a series of factors including: the age of the company, prior financing history, company status, participating investors, and more. Growth equity: Rounds must include at least one investor tagged as growth/expansion, while deal size must either be $15 million or more (although rounds of undisclosed size that meet all other criteria are included). In addition, the deal must be classified as growth/expansion or later-stage VC in the PitchBook Platform. If the financing is tagged as late-stage VC it is included regardless of industry. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Also, if a company is tagged with any PitchBook vertical, excepting manufacturing and infrastructure, it is kept. Otherwise, the following industries are excluded from growth equity financing calculations: buildings and property, thrifts and mortgage finance, real estate investment trusts, and oil & gas equipment, utilities, exploration, production and refining. Lastly, the company in question must not have had an M&A event, buyout, or IPO completed prior to the round in question. Corporate venture capital: Financings classified as corporate venture capital include rounds that saw both firms investing via established CVC arms or corporations making equity investments off balance sheets or whatever other non-CVC method actually employed. Exits PitchBook includes the first majority liquidity event for holders of equity securities of venture-backed companies. This includes events where there is a public market for the shares (IPO) or the acquisition of the majority of the equity by another entity (corporate or financial acquisition). This does not include secondary sales, further sales after the initial liquidity event, or bankruptcies. M&A value is based on reported or disclosed figures, with no estimation used to assess the value of transactions for which the actual deal size is unknown. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC