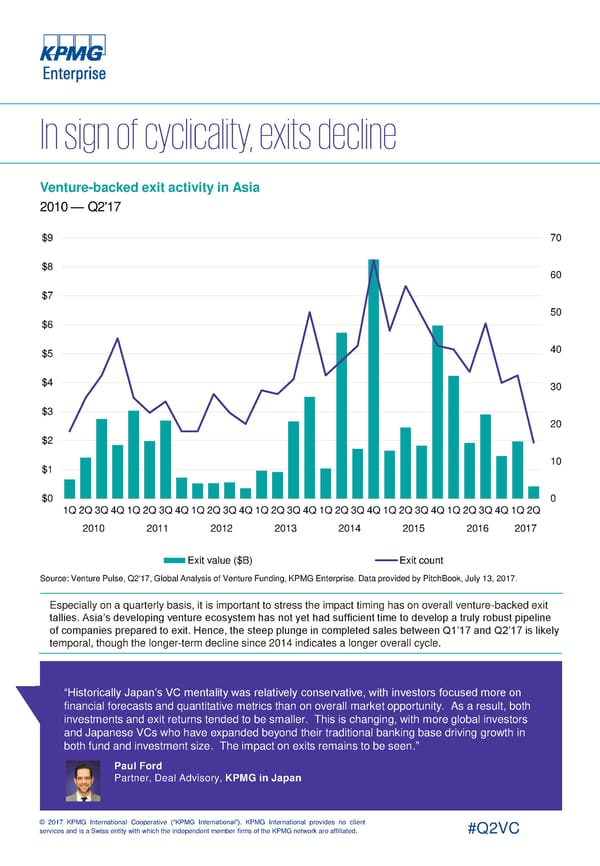

Venture-backed exit activity in Asia 2010 — Q2'17 $9 70 $8 60 $7 50 $6 $5 40 $4 30 $3 20 $2 $1 10 $0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Exit value ($B) Exit count Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Especially on a quarterly basis, it is important to stress the impact timing has on overall venture-backed exit tallies. Asia’s developing venture ecosystem has not yet had sufficient time to develop a truly robust pipeline of companies prepared to exit. Hence, the steep plunge in completed sales between Q1’17 and Q2’17 is likely temporal, though the longer-term decline since 2014 indicates a longer overall cycle. “Historically Japan’s VC mentality was relatively conservative, with investors focused more on financial forecasts and quantitative metrics than on overall market opportunity. As a result, both investments and exit returns tended to be smaller. This is changing, with more global investors and Japanese VCs who have expanded beyond their traditional banking base driving growth in both fund and investment size. The impact on exits remains to be seen.” Paul Ford Patrick Imbach Partner, Deal Advisory, KPMG in Japan Co-Head of KPMG Tech Growth, KPMG in the UK © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Asia Page 11 Page 13

Asia Page 11 Page 13