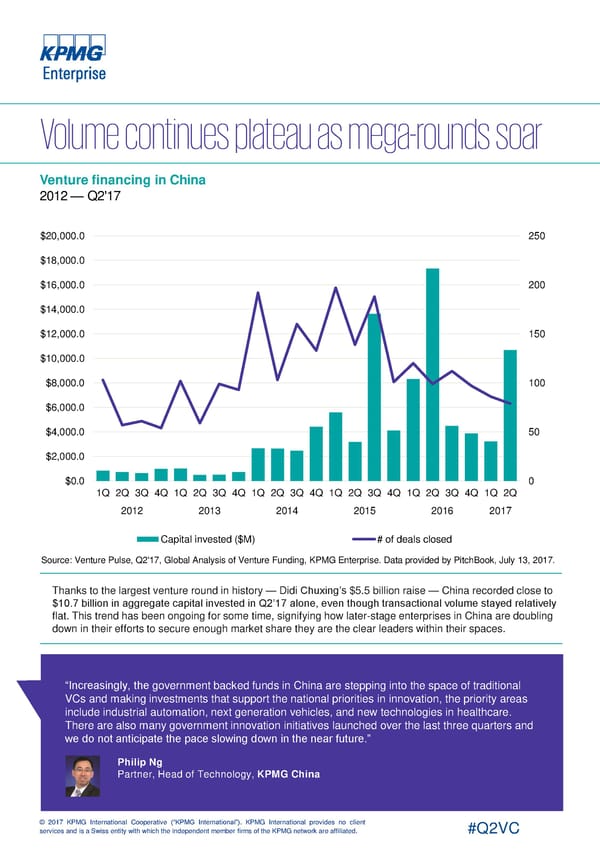

Venture financing in China 2012 — Q2'17 $20,000.0 250 $18,000.0 $16,000.0 200 $14,000.0 $12,000.0 150 $10,000.0 $8,000.0 100 $6,000.0 $4,000.0 50 $2,000.0 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Thanks to the largest venture round in history — Didi Chuxing’s $5.5 billion raise — China recorded close to $10.7 billion in aggregate capital invested in Q2’17 alone, even though transactional volume stayed relatively flat. This trend has been ongoing for some time, signifying how later-stage enterprises in China are doubling down in their efforts to secure enough market share they are the clear leaders within their spaces. “Increasingly, the government backed funds in China are stepping into the space of traditional VCs and making investments that support the national priorities in innovation, the priority areas include industrial automation, next generation vehicles, and new technologies in healthcare. There are also many government innovation initiatives launched over the last three quarters and we do not anticipate the pace slowing down in the near future.” Patrick Imbach Philip Ng Co-Head of KPMG Tech Growth, Partner, Head of Technology, KPMG China KPMG in the UK © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Asia Page 17 Page 19

Asia Page 17 Page 19