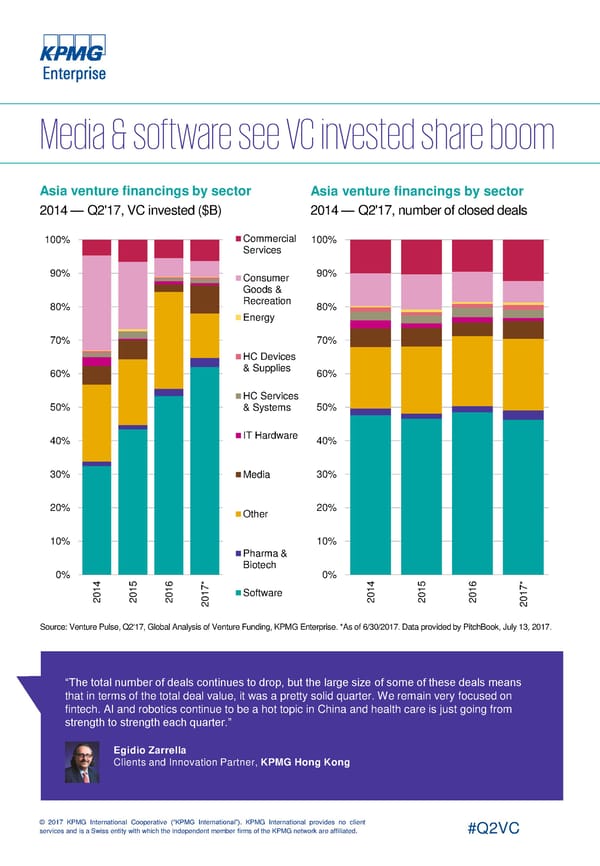

Asia venture financings by sector Asia venture financings by sector 2014 — Q2'17, VC invested ($B) 2014 — Q2'17, number of closed deals 100% Commercial 100% Services 90% Consumer 90% Goods & 80% Recreation 80% Energy 70% 70% HC Devices 60% & Supplies 60% HC Services 50% & Systems 50% 40% IT Hardware 40% 30% Media 30% 20% Other 20% 10% 10% Pharma & 0% Biotech 0% 4 5 6 * 4 5 6 * 1 1 1 7 1 1 1 7 0 0 0 1 Software 0 0 0 1 2 2 2 0 2 2 2 0 2 2 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook,July 13, 2017. “The total number of deals continues to drop, but the large size of some of these deals means that in terms of the total deal value, it was a pretty solid quarter. We remain very focused on fintech. AI and robotics continue to be a hot topic in China and health care is just going from strength to strength each quarter.” Patrick Imbach Co-Head of KPMG Tech Growth, Egidio Zarrella Clients and Innovation Partner, KPMG Hong Kong KPMG in the UK © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Asia Page 8 Page 10

Asia Page 8 Page 10