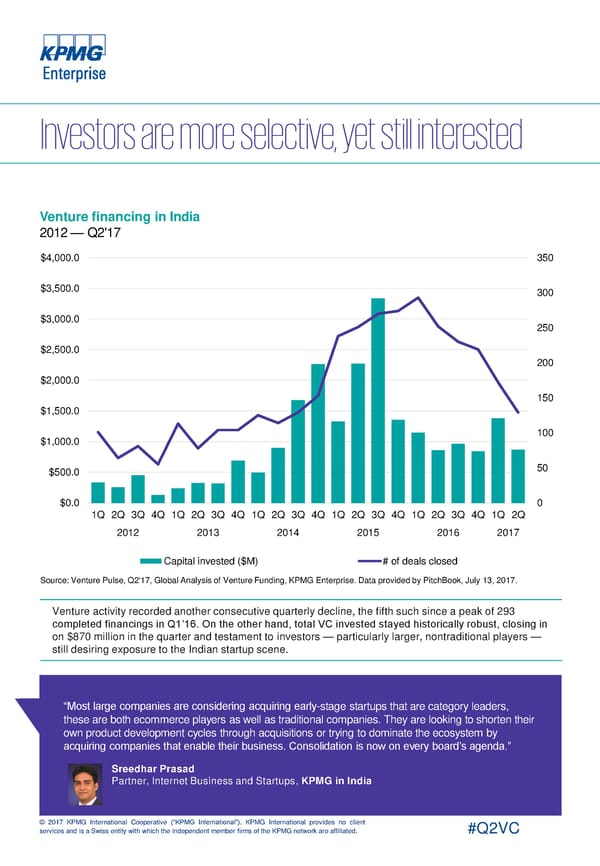

Venture financing in India 2012 — Q2'17 $4,000.0 350 $3,500.0 300 $3,000.0 250 $2,500.0 200 $2,000.0 150 $1,500.0 $1,000.0 100 $500.0 50 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Venture activity recorded another consecutive quarterly decline, the fifth such since a peak of 293 completed financings in Q1’16. On the other hand, total VC invested stayed historically robust, closing in on $870 million in the quarter and testament to investors — particularly larger, nontraditional players — still desiring exposure to the Indian startup scene. “Most large companies are considering acquiring early-stage startups that are category leaders, these are both ecommerce players as well as traditional companies. They are looking to shorten their own product development cycles through acquisitions or trying to dominate the ecosystem by acquiring companies that enable their business. Consolidation is now on every board’s agenda.” Patrick Imbach Sreedhar Prasad Partner, Internet Business and Startups, KPMG in India Co-Head of KPMG Tech Growth, KPMG in the UK © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Asia Page 16 Page 18

Asia Page 16 Page 18