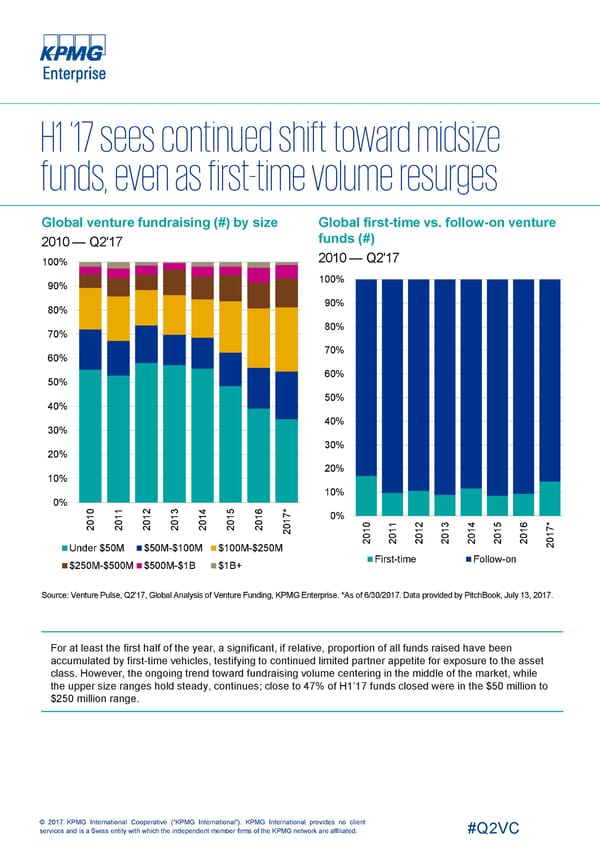

Global venture fundraising (#) by size Global first-time vs. follow-on venture funds (#) 2010 — Q2'17 2010 — Q2'17 100% 100% 90% 90% 80% 80% 70% 70% 60% 60% 50% 50% 40% 40% 30% 30% 20% 20% 10% 10% 0% 0 1 2 3 5 6 * 1 1 1 1 14 1 1 7 0% 0 0 0 0 0 0 1 * 0 0 1 2 3 4 5 6 2 2 2 2 20 2 2 7 2 1 1 1 1 1 1 1 0 0 0 0 0 0 0 1 2 2 2 2 2 2 2 0 2 Under $50M $50M-$100M $100M-$250M First-time Follow-on $250M-$500M $500M-$1B $1B+ Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. For at least the first half of the year, a significant, if relative, proportion of all funds raised have been accumulated by first-time vehicles, testifying to continued limited partner appetite for exposure to the asset class. However, the ongoing trend toward fundraising volume centering in the middle of the market, while the upper size ranges hold steady, continues; close to 47% of H1’17 funds closed were in the $50 million to $250 million range. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Global Page 29 Page 31

Global Page 29 Page 31