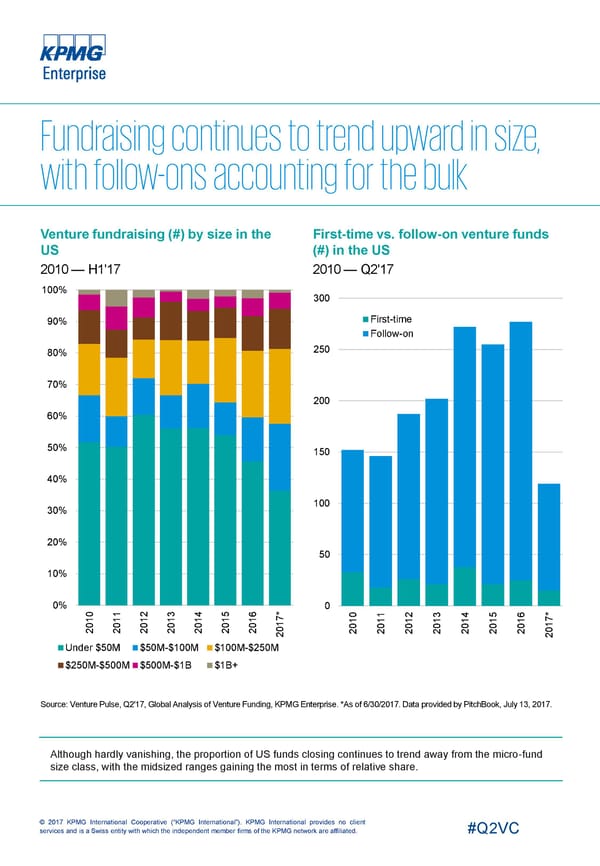

Venture fundraising (#) by size in the First-time vs. follow-on venture funds US (#) in the US 2010 — H1'17 2010 — Q2'17 100% 300 First-time 90% Follow-on 250 80% 70% 200 60% 50% 150 40% 100 30% 20% 50 10% 0% 0 0 1 2 3 4 5 6 * * 0 1 2 3 4 5 6 1 1 1 1 1 1 1 7 7 1 1 1 1 1 1 1 0 0 0 0 0 0 0 1 0 0 0 0 0 0 0 1 2 2 2 2 2 2 2 0 0 2 2 2 2 2 2 2 2 2 Under $50M $50M-$100M $100M-$250M $250M-$500M $500M-$1B $1B+ Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. Although hardly vanishing, the proportion of US funds closing continues to trend away from the micro-fund size class, with the midsized ranges gaining the most in terms of relative share. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

USA Page 18 Page 20

USA Page 18 Page 20