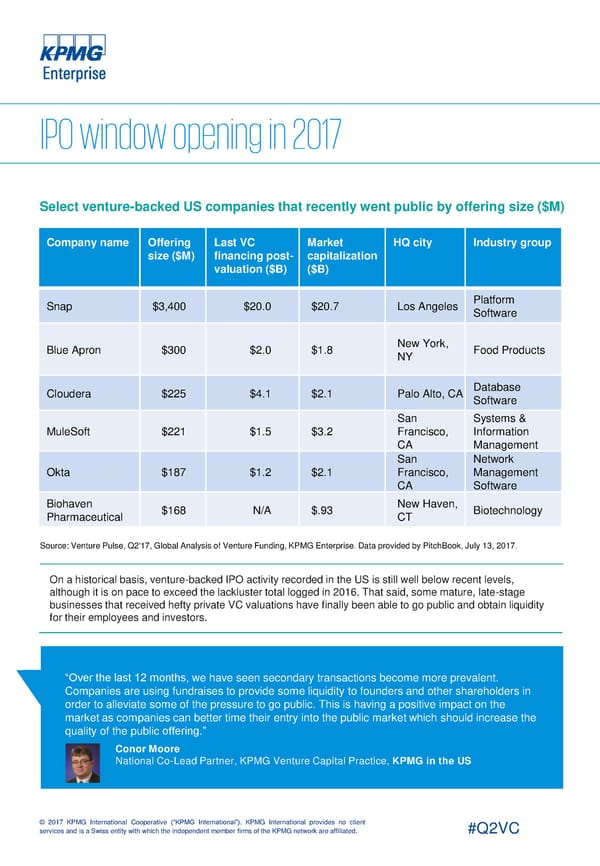

Select venture-backed US companies that recently went public by offering size ($M) Company name Offering Last VC Market HQ city Industry group size ($M) financing post- capitalization valuation ($B) ($B) Snap $3,400 $20.0 $20.7 Los Angeles Platform Software Blue Apron $300 $2.0 $1.8 New York, Food Products NY Cloudera $225 $4.1 $2.1 Palo Alto, CA Database Software San Systems & MuleSoft $221 $1.5 $3.2 Francisco, Information CA Management San Network Okta $187 $1.2 $2.1 Francisco, Management CA Software Biohaven $168 N/A $.93 New Haven, Biotechnology Pharmaceutical CT Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. On a historical basis, venture-backed IPO activity recorded in the US is still well below recent levels, although it is on pace to exceed the lackluster total logged in 2016. That said, some mature, late-stage businesses that received hefty private VC valuations have finally been able to go public and obtain liquidity for their employees and investors. “Over the last 12 months, we have seen secondary transactions become more prevalent. Companies are using fundraises to provide some liquidity to founders and other shareholders in order to alleviate some of the pressure to go public. This is having a positive impact on the market as companies can better time their entry into the public market which should increase the quality of the public offering.” Conor Moore National Co-Lead Partner, KPMG Venture Capital Practice, KPMG in the US © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

USA Page 24 Page 26

USA Page 24 Page 26