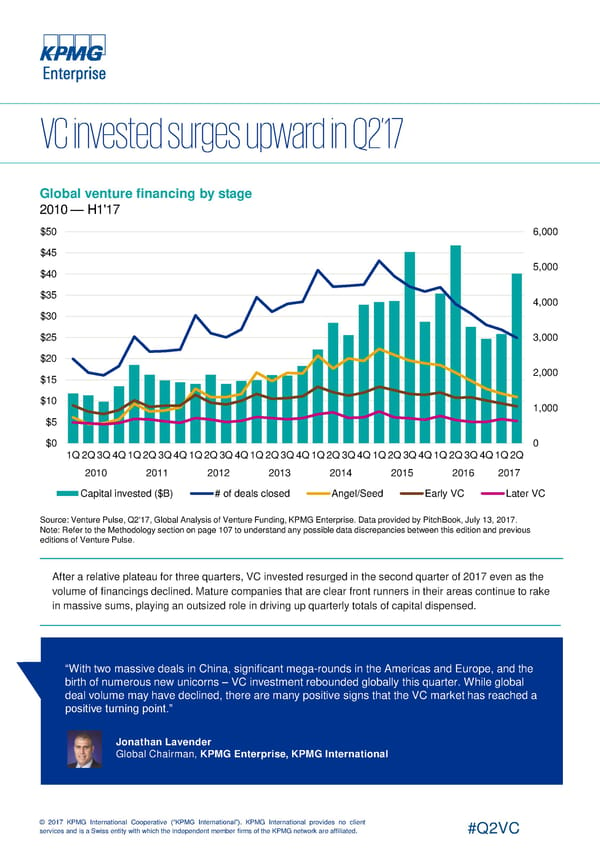

Global venture financing by stage 2010 — H1'17 $50 6,000 $45 $40 5,000 $35 4,000 $30 $25 3,000 $20 $15 2,000 $10 1,000 $5 $0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Capital invested ($B) # of deals closed Angel/Seed Early VC Later VC Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Note: Refer to the Methodology section on page 107 to understand any possible data discrepancies between this edition and previous editions of Venture Pulse. After a relative plateau for three quarters, VC invested resurged in the second quarter of 2017 even as the volume of financings declined. Mature companies that are clear front runners in their areas continue to rake in massive sums, playing an outsized role in driving up quarterly totals of capital dispensed. “With two massive deals in China, significant mega-rounds in the Americas and Europe, and the birth of numerous new unicorns – VC investment rebounded globally this quarter. While global deal volume may have declined, there are many positive signs that the VC market has reached a positive turning point.” Jonathan Lavender Global Chairman, KPMG Enterprise, KPMG International © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Global Page 4 Page 6

Global Page 4 Page 6