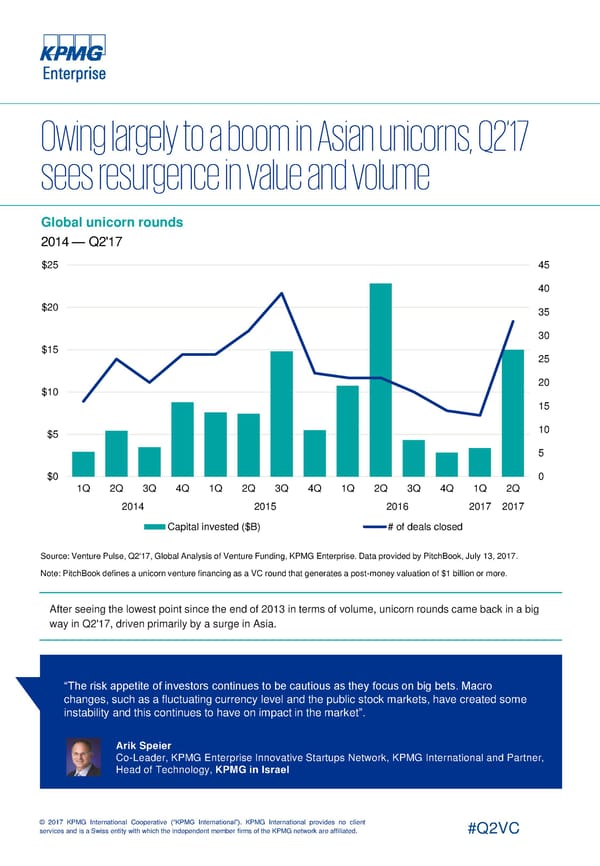

Global unicorn rounds 2014 — Q2'17 $25 45 40 $20 35 30 $15 25 $10 20 15 $5 10 5 $0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2014 2015 2016 2017 2017 Capital invested ($B) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Note: PitchBook defines a unicorn venture financing as a VC round that generates a post-money valuation of $1 billion or more. After seeing the lowest point since the end of 2013 in terms of volume, unicorn rounds came back in a big way in Q2'17, driven primarily by a surge in Asia. “The risk appetite of investors continues to be cautious as they focus on big bets. Macro changes, such as a fluctuating currency level and the public stock markets, have created some instability and this continues to have on impact in the market”. Arik Speier Co-Leader, KPMG Enterprise Innovative Startups Network, KPMG International and Partner, Head of Technology, KPMG in Israel © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Global Page 15 Page 17

Global Page 15 Page 17