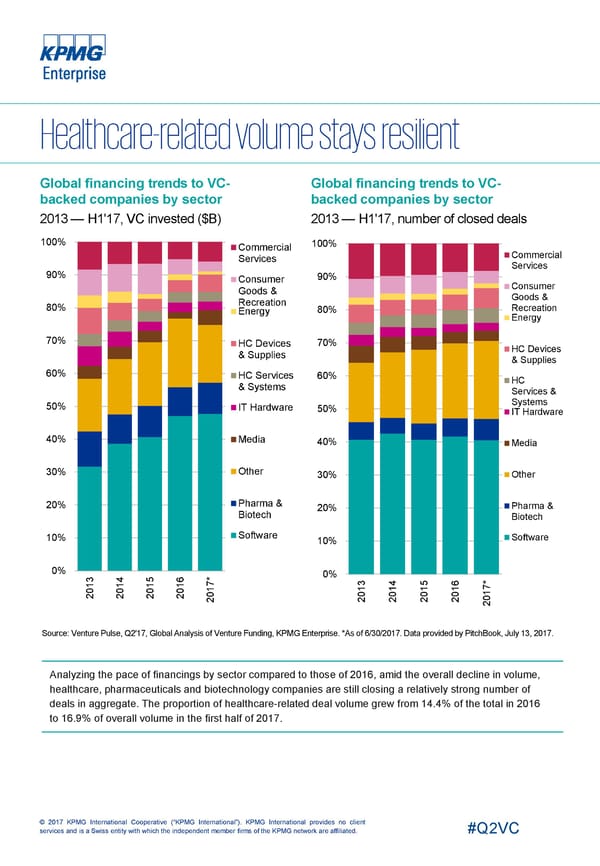

Global financing trends to VC- Global financing trends to VC- backedcompanies by sector backedcompanies by sector 2013 — H1'17, VC invested ($B) 2013 — H1'17, number of closed deals 100% 100% Commercial Commercial Services Services 90% 90% Consumer Consumer Goods & Goods & Recreation 80% Recreation 80% Energy Energy 70% HC Devices 70% HC Devices & Supplies & Supplies 60% HC Services 60% HC & Systems Services & Systems 50% IT Hardware 50% IT Hardware 40% Media 40% Media 30% Other 30% Other Pharma & 20% Pharma & 20% Biotech Biotech Software 10% Software 10% 0% 0% 3 4 5 6 * 7 3 5 6 * 1 1 1 1 7 0 0 0 0 1 1 14 1 1 0 0 0 0 1 2 2 2 2 0 2 2 20 2 2 2 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. Analyzing the pace of financings by sector compared to those of 2016, amid the overall decline in volume, healthcare, pharmaceuticals and biotechnology companies are still closing a relatively strong number of deals in aggregate. The proportion of healthcare-related deal volume grew from 14.4% of the total in 2016 to 16.9% of overall volume in the first half of 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Global Page 10 Page 12

Global Page 10 Page 12