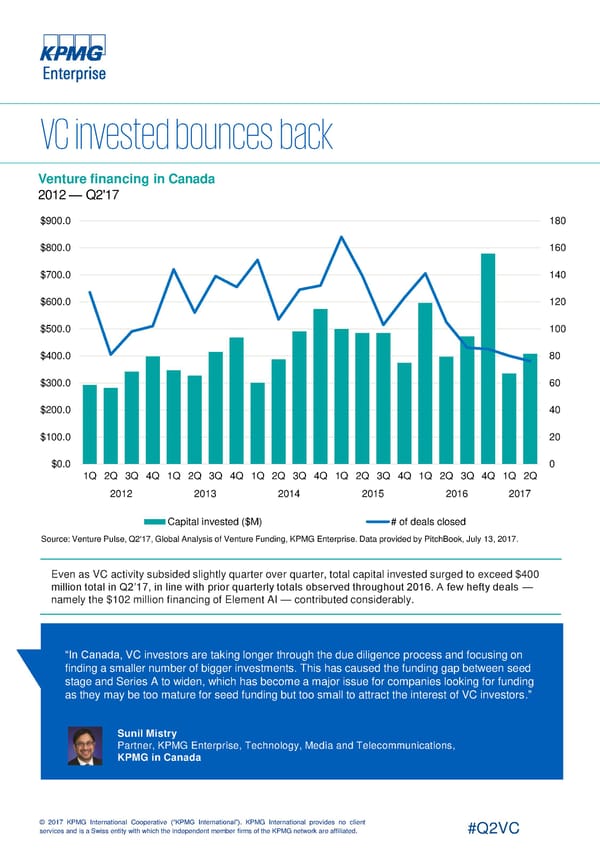

Venture financing in Canada 2012 — Q2'17 $900.0 180 $800.0 160 $700.0 140 $600.0 120 $500.0 100 $400.0 80 $300.0 60 $200.0 40 $100.0 20 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Even as VC activity subsided slightly quarter over quarter, total capital invested surged to exceed $400 million total in Q2’17, in line with prior quarterly totals observed throughout 2016. A few hefty deals — namely the $102 million financing of Element AI — contributed considerably. “In Canada, VC investors are taking longer through the due diligence process and focusing on finding a smaller number of bigger investments. This has caused the funding gap between seed stage and Series A to widen, which has become a major issue for companies looking for funding as they may be too mature for seed funding but too small to attract the interest of VC investors.” Sunil Mistry Partner, KPMG Enterprise, Technology, Media and Telecommunications, KPMG in Canada © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

Americas Page 9 Page 11

Americas Page 9 Page 11