Americas

Investment in the Americas level outside of the US

In Q2'17 VC-backed companies in the Americas raised across 2,062 deals

While the US experienced a relatively strong quarter of investment in Q2’17, other countries within the Americas fell behind pace compared to previous quarters. In Canada, for example, while VC investment increased deal volume saw a decrease. VC activity in Latin America also remained relatively weak. Due diligence lengthening deal time Q2’17 saw VC investors across the Americas taking more time to evaluate potential deals and conduct related due diligence. While deals continue to get completed, the runway required to make a deal has been extended. This has likely contributed to the decline in deals activity during the quarter. However, the lack of deals activity does not necessarily reflect waning VC market deal volume outside of the US. High investment volume still exist as they relate to specific sectors and segments, including fintech or healthtech. Changing market conditions have simply extended the time required to get deals completed successfully. early-stage funding gap grows In Q2’17, there was a plateau in VC funding for early-stage deals — particularly those that fit between the typical characteristics of seed stage and early-stage deals. While numerous programs exist to provide seed stage funding and support to startups across the Americas, a noticeable funding gap has appeared for slightly more mature companies looking for funding. The challenge relates to the changing characteristics of VC investors given the still-turbulent geopolitical and economic environment across much of the Americas. Many VC investors have slowed down or stopped making broad investments in early-stage companies, preferring to focus specifically on companies well positioned to achieve success. This has led to companies struggling to obtain small rounds of funding because they are unable to entice enough interest from VC investors. This struggle could have long-term ramifications for the VC market over time, should the trend continue. Healthtech remains key priority in Canada In Canada, healthtech remains a key area of VC interest and attention, a trend expected to continue for the foreseeable future. Both federal and provincial governments have been making significant investments in the health sector, including providing funding for new hospitals. These investments will likely spur investment in related technologies as hospitals vie to become the most technologically advanced in the country. Brazil evolving into Latin America innovation hub In Q2’17, Brazil continued its evolution into a strong Latin America innovation hub. In recent quarters, San Paulo in particular has seen an increase in the number of global companies setting up shop locally, while incubator models (e.g. plug.co, CUBO) and accelerator models (ACE) have started to thrive there. Brazil has also seen an increase in the availability of VC funds locally, and a growing interest among VC investors for using Brazil as a platform for growth in Latin America. During Q2’17, KaszeK Ventures closed a fund focused on Latin America valued at US$200 million, its third and largest fund to date. KaszeKVentures stated that the purpose of this fund will be on continuing to grow the tech ecosystem 6 in Latin America. 6 https://lavca.org/2017/06/02/kaszek-ventures-closes-us200m-latin-america-tech-fund/ © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

While Brazil is still working to gain traction among international investors, there are significant positive signs for the future. In Q2’17, ridesharing company 99 completed a fundraising round of $200 million, with a $100 million investment by Softbank from Japan. Over time, it is expected that deal activity will only increase as companies involved in different incubators and accelerators begin to mature. Trends to watch for in the Americas Through the remainder of 2017, healthtech is expected to remain a hotbed for VC investment activity, driven by the growing focus on innovation and the desire to make healthcare services more proactive, efficient and effective. Artificial intelligence, cybersecurity, blockchain and fintech are also expected to remain on the radar of investors. Over time, there will also likely be additional investor attention given to building innovation hubs, incubators and accelerators in Mexico and Latin America in order to better access these markets and provide tech-enabled services to their relatively large populations. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

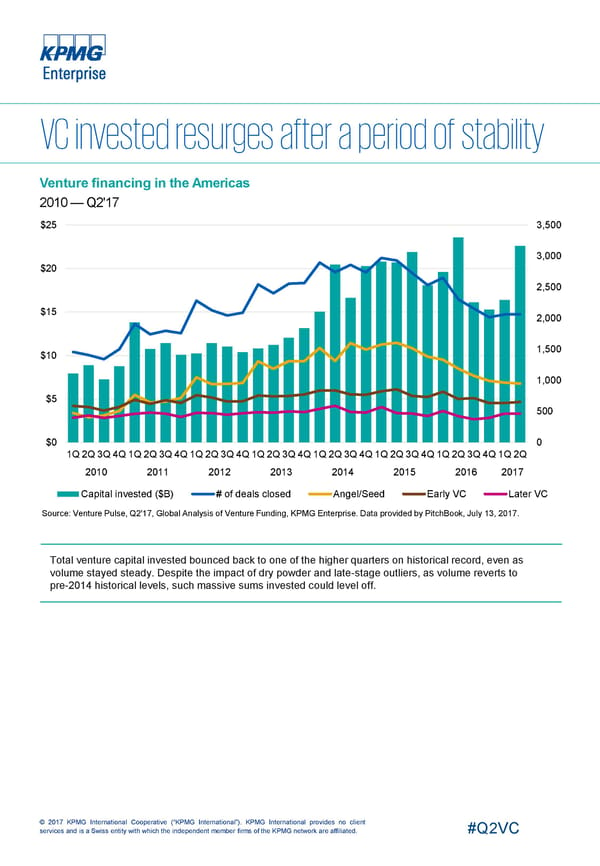

Venture financing in the Americas 2010 —Q2'17 $25 3,500 3,000 $20 2,500 $15 2,000 1,500 $10 1,000 $5 500 $0 0 1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q 2010 2011 2012 2013 2014 2015 2016 2017 Capital invested ($B) # of deals closed Angel/Seed Early VC Later VC Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Total venture capital invested bounced back to one of the higher quarters on historical record, even as volume stayed steady. Despite the impact of dry powder and late-stage outliers, as volume reverts to pre-2014 historical levels, such massive sums invested could level off. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

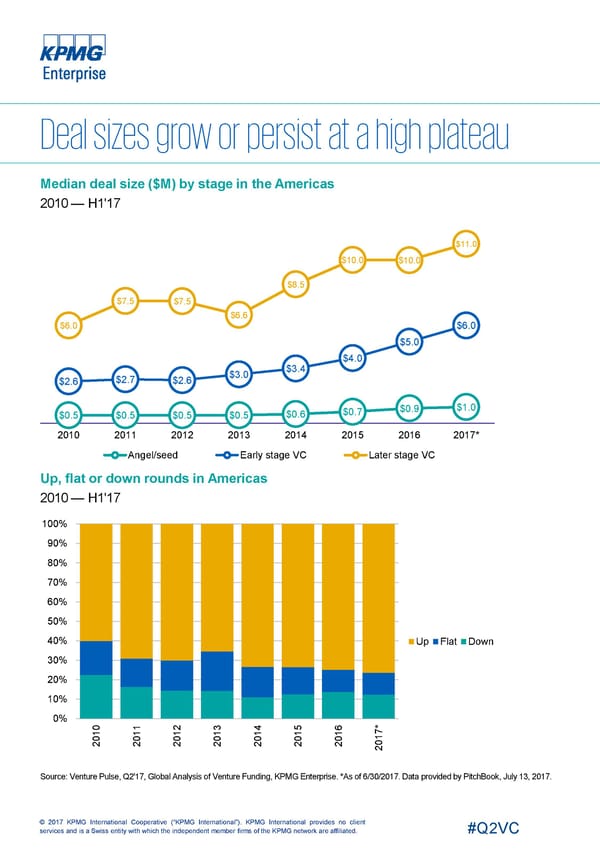

Median deal size ($M) by stage in the Americas 2010 — H1'17 $11.0 $10.0 $10.0 $8.5 $7.5 $7.5 $6.6 $6.0 $6.0 $5.0 $4.0 $3.4 $3.0 $2.7 $2.6 $2.6 $1.0 $0.9 $0.7 $0.6 $0.5 $0.5 $0.5 $0.5 2010 2011 2012 2013 2014 2015 2016 2017* Angel/seed Early stage VC Later stage VC Up, flat or down rounds in Americas 2010 — H1'17 100% 90% 80% 70% 60% 50% 40% Up Flat Down 30% 20% 10% 0% 0 1 2 3 4 5 6 * 1 1 1 1 1 1 1 7 0 0 0 0 0 0 0 1 2 2 2 2 2 2 2 0 2 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

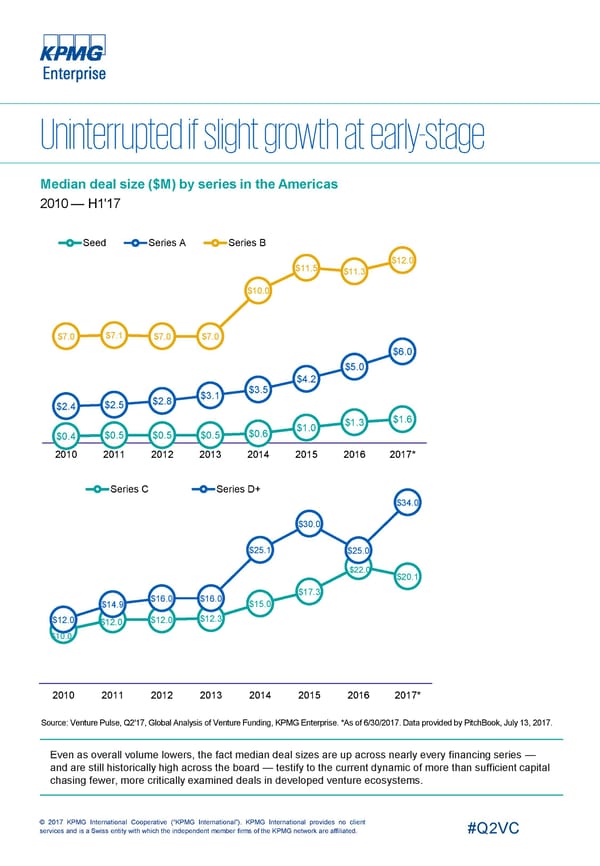

Median deal size ($M) by series in the Americas 2010 — H1'17 Seed Series A Series B $12.0 $11.5 $11.3 $10.0 $7.1 $7.0 $7.0 $7.0 $6.0 $5.0 $4.2 $3.5 $3.1 $2.8 $2.5 $2.4 $1.6 $1.3 $1.0 $0.6 $0.4 $0.5 $0.5 $0.5 2010 2011 2012 2013 2014 2015 2016 2017* Series C Series D+ $34.0 $30.0 $25.1 $25.0 $22.0 $20.1 $17.3 $16.0 $16.0 $14.9 $15.0 $12.3 $12.0 $12.0 $12.0 $10.0 2010 2011 2012 2013 2014 2015 2016 2017* Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. Even as overall volume lowers, the fact median deal sizes are up across nearly every financing series — and are still historically high across the board — testify to the current dynamic of more than sufficient capital chasing fewer, more critically examined deals in developed venture ecosystems. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

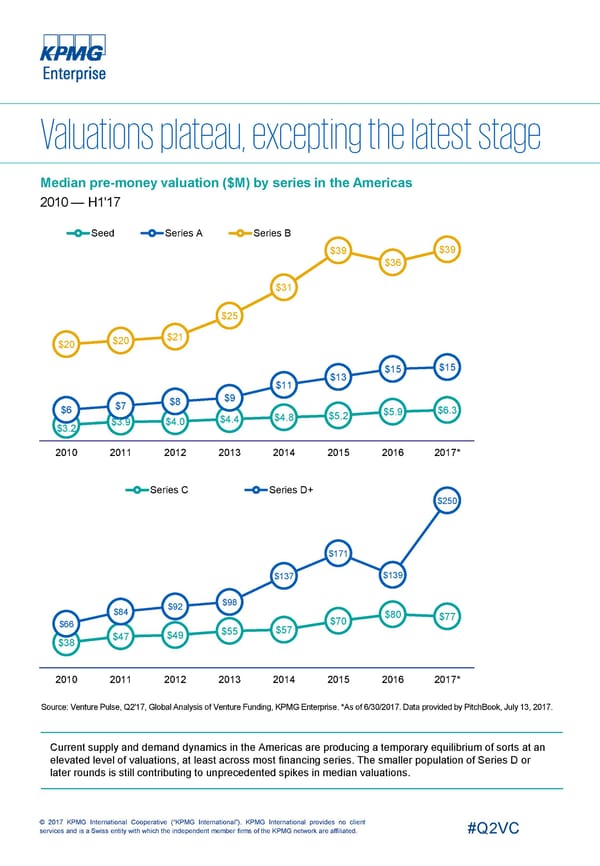

Median pre-money valuation ($M) by series in the Americas 2010 — H1'17 Seed Series A Series B $39 $39 $36 $31 $25 $21 $20 $20 $15 $15 $13 $11 $9 $8 $7 $6 $6.3 $5.9 $5.2 $4.8 $4.4 $3.9 $4.0 $3.2 2010 2011 2012 2013 2014 2015 2016 2017* Series C Series D+ $250 $171 $137 $139 $98 $92 $84 $80 $77 $70 $66 $57 $55 $49 $47 $38 2010 2011 2012 2013 2014 2015 2016 2017* Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. Current supply and demand dynamics in the Americas are producing a temporary equilibrium of sorts at an elevated level of valuations, at least across most financing series. The smaller population of Series D or later rounds is still contributing to unprecedented spikes in median valuations. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

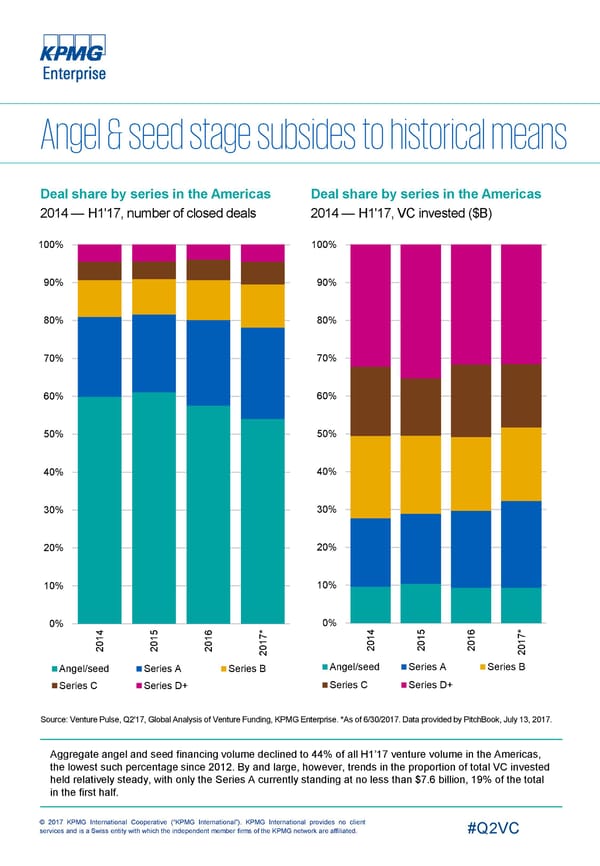

Deal share by series in the Americas Deal share by series in the Americas 2014 — H1'17, number of closed deals 2014 — H1'17, VC invested ($B) 100% 100% 90% 90% 80% 80% 70% 70% 60% 60% 50% 50% 40% 40% 30% 30% 20% 20% 10% 10% 0% 0% * 4 6 * 4 5 6 7 1 15 1 7 1 1 1 1 0 0 1 0 0 0 0 2 20 2 0 2 2 2 2 2 Angel/seed Series A Series B Angel/seed Series A Series B Series C Series D+ Series C Series D+ Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. Aggregate angel and seed financing volume declined to 44% of all H1’17 venture volume in the Americas, the lowest such percentage since 2012. By and large, however, trends in the proportion of total VC invested held relatively steady, with only the Series A currently standing at no less than $7.6 billion, 19% of the total in the first half. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

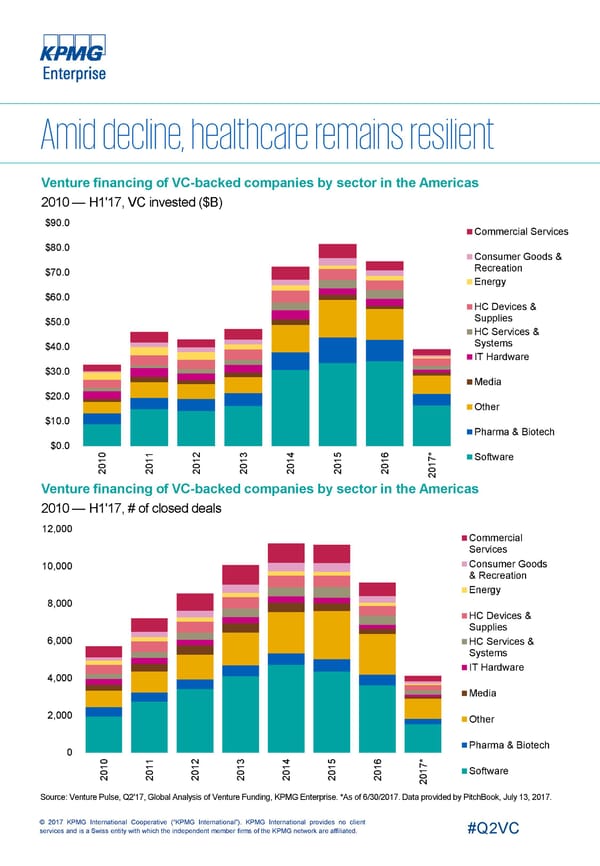

Venture financing of VC-backed companies by sector in the Americas 2010 — H1'17, VC invested ($B) $90.0 Commercial Services $80.0 Consumer Goods & Recreation $70.0 Energy $60.0 HC Devices & Supplies $50.0 HC Services & Systems $40.0 IT Hardware $30.0 Media $20.0 Other $10.0 Pharma & Biotech $0.0 0 1 2 3 4 5 6 * 7 Software 1 1 1 1 1 1 1 0 0 0 0 0 0 0 1 2 2 2 2 2 2 2 0 2 Venture financing of VC-backed companies by sector in the Americas 2010 — H1'17, # of closed deals 12,000 Commercial Services Consumer Goods 10,000 & Recreation Energy 8,000 HC Devices & Supplies 6,000 HC Services & Systems IT Hardware 4,000 Media 2,000 Other Pharma & Biotech 0 0 1 2 3 4 5 6 * 1 1 1 1 1 1 1 7 0 0 0 0 0 0 0 1 Software 2 2 2 2 2 2 2 0 2 Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. *As of 6/30/2017. Data provided by PitchBook, July 13, 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

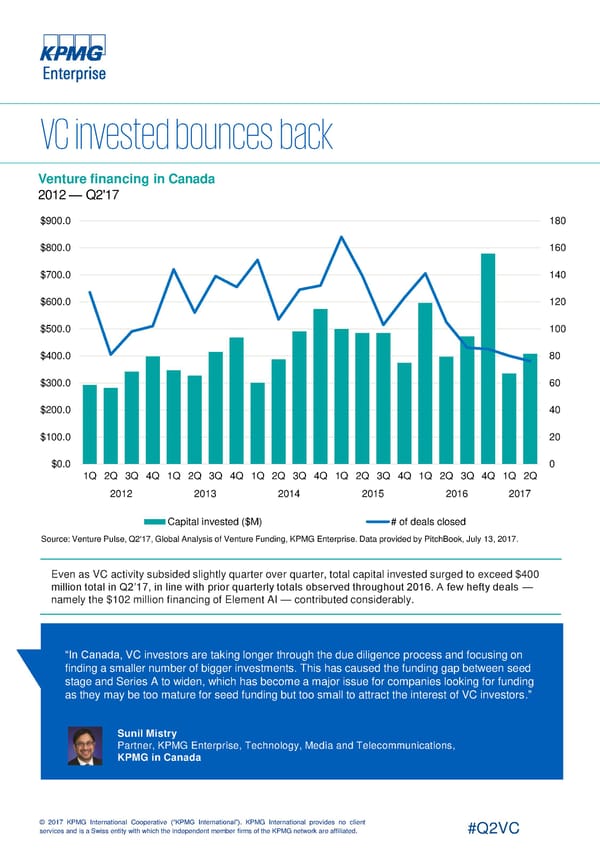

Venture financing in Canada 2012 — Q2'17 $900.0 180 $800.0 160 $700.0 140 $600.0 120 $500.0 100 $400.0 80 $300.0 60 $200.0 40 $100.0 20 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Even as VC activity subsided slightly quarter over quarter, total capital invested surged to exceed $400 million total in Q2’17, in line with prior quarterly totals observed throughout 2016. A few hefty deals — namely the $102 million financing of Element AI — contributed considerably. “In Canada, VC investors are taking longer through the due diligence process and focusing on finding a smaller number of bigger investments. This has caused the funding gap between seed stage and Series A to widen, which has become a major issue for companies looking for funding as they may be too mature for seed funding but too small to attract the interest of VC investors.” Sunil Mistry Partner, KPMG Enterprise, Technology, Media and Telecommunications, KPMG in Canada © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

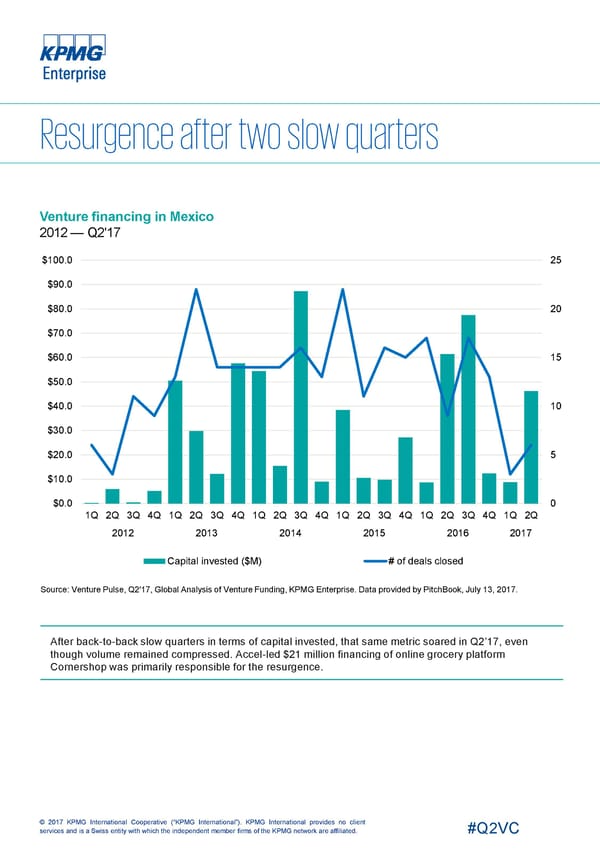

Venture financing in Mexico 2012 — Q2'17 $100.0 25 $90.0 $80.0 20 $70.0 $60.0 15 $50.0 $40.0 10 $30.0 $20.0 5 $10.0 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. After back-to-back slow quarters in terms of capital invested, that same metric soared in Q2’17, even though volume remained compressed. Accel-led $21 million financing of online grocery platform Cornershopwas primarily responsible for the resurgence. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

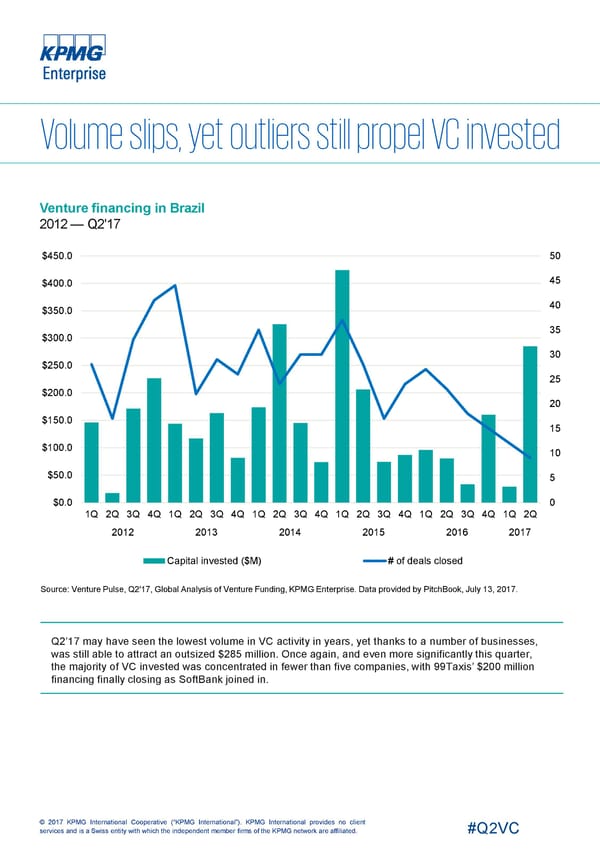

Venture financing in Brazil 2012 — Q2'17 $450.0 50 45 $400.0 40 $350.0 35 $300.0 30 $250.0 25 $200.0 20 $150.0 15 $100.0 10 $50.0 5 $0.0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 2012 2013 2014 2015 2016 2017 Capital invested ($M) # of deals closed Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. Q2’17 may have seen the lowest volume in VC activity in years, yet thanks to a number of businesses, was still able to attract an outsized $285 million. Once again, and even more significantly this quarter, the majority of VC invested was concentrated in fewer than five companies, with 99Taxis’ $200 million financing finally closing as SoftBank joined in. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC

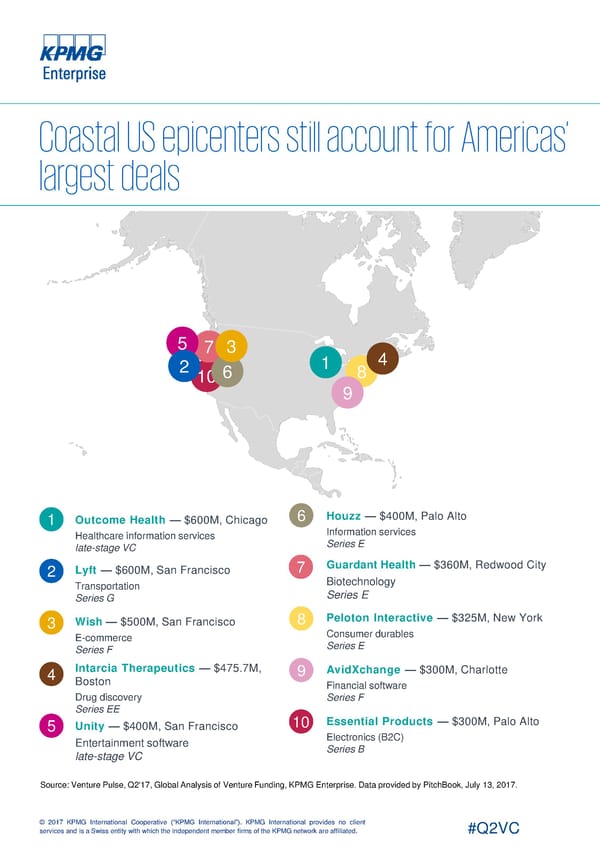

5 7 3 4 2 10 6 1 8 9 1 Outcome Health — $600M, Chicago 6 Houzz —$400M, Palo Alto Healthcare information services Information services late-stage VC Series E 2 Lyft — $600M, San Francisco 7 Guardant Health — $360M, Redwood City Transportation Biotechnology Series G Series E 3 Wish — $500M, San Francisco 8 Peloton Interactive — $325M, New York E-commerce Consumer durables Series F Series E 4 Intarcia Therapeutics — $475.7M, 9 AvidXchange — $300M, Charlotte Boston Financial software Drug discovery Series F Series EE 5 Unity — $400M, San Francisco 10 Essential Products — $300M, Palo Alto Entertainment software Electronics (B2C) late-stage VC Series B Source: Venture Pulse, Q2'17, Global Analysis of Venture Funding, KPMG Enterprise. Data provided by PitchBook, July 13, 2017. © 2017 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. #Q2VC